Delving into the world of Commercial Auto Policy Limits, this paragraph sets the stage for an informative journey, offering valuable insights and perspectives to the readers.

Exploring the nuances of policy limits in commercial auto insurance is crucial for businesses to navigate the complexities of coverage effectively.

Overview of Commercial Auto Policy Limits

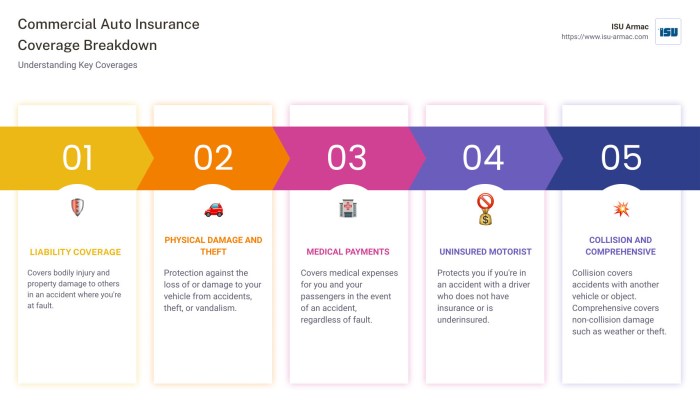

Commercial auto policy limits refer to the maximum amount an insurance company will pay for covered claims under a commercial auto insurance policy. It is crucial for businesses to understand these limits to ensure adequate protection in case of accidents or damages involving company vehicles.

How Policy Limits Work

- For example, if a business has a policy limit of $500,000 per accident and a claim is filed for $700,000 in damages, the insurance company will only pay up to the policy limit of $500,000.

- Policy limits can vary depending on the type of coverage, such as liability, collision, or comprehensive, and can be set per accident or per occurrence.

- Understanding policy limits is crucial for businesses to assess their risk exposure and determine if additional coverage or higher limits are necessary to protect their assets.

Types of Commercial Auto Policy Limits

When it comes to commercial auto insurance, policy limits play a crucial role in determining the coverage and protection offered to businesses. There are two main types of commercial auto policy limits

single limit and split limit policies.

Single Limit Policies

Single limit policies provide a fixed total amount of coverage for all claims resulting from a single accident, regardless of the number of people injured or the extent of property damage. For example, a commercial auto policy with a single limit of $1 million would cover all liability costs up to that amount in the event of an accident.

Split Limit Policies

Split limit policies, on the other hand, specify separate limits for bodily injury per person, bodily injury per accident, and property damage per accident. For instance, a commercial auto policy with split limits of $100,000/$300,000/$50,000 means that the insurance company will pay up to $100,000 for bodily injury per person, $300,000 for bodily injury per accident, and $50,000 for property damage per accident.

Pros and Cons

- Single Limit Policies:

- Pros: Simplicity in coverage calculation, potentially higher total coverage amount.

- Cons: Limited flexibility in distributing coverage among different types of claims, higher premiums.

- Split Limit Policies:

- Pros: Ability to allocate coverage amounts for different types of claims, potentially lower premiums.

- Cons: Complexity in understanding coverage limits, risk of inadequate coverage for certain claim scenarios.

Factors Affecting Policy Limits

When it comes to determining policy limits for commercial auto insurance, several key factors come into play. The size and type of business, as well as the risk assessment conducted by the insurance provider, all play a crucial role in setting appropriate policy limits.

Size and Type of Business

The size and type of business are significant factors that influence the determination of policy limits. A larger business with a fleet of vehicles will likely require higher policy limits to adequately cover all vehicles and potential liabilities. On the other hand, a small business with only a few vehicles may require lower policy limits to meet their insurance needs.

Risk Assessment

Insurance providers conduct risk assessments to evaluate the level of risk associated with insuring a particular business. Factors such as the industry in which the business operates, the driving records of employees, and the frequency of vehicle use are all taken into consideration.

Based on this assessment, appropriate policy limits are set to ensure adequate coverage in case of any accidents or claims.

Coverage Limits vs. State Requirements

When it comes to commercial auto insurance, it's crucial to understand how coverage limits set by insurance companies compare to the minimum state requirements. Meeting state requirements is essential for ensuring compliance and protection in case of accidents or other incidents.

Comparing Coverage Limits

- Insurance companies may offer varying coverage limits for commercial auto policies based on factors such as the type of vehicles, business operations, and risk assessment.

- State requirements, on the other hand, dictate the minimum amount of coverage that businesses must have to legally operate commercial vehicles within the state.

- It's important for businesses to review both the coverage limits offered by insurance companies and the state requirements to determine the most appropriate coverage for their needs.

Importance of Meeting State Requirements

- Meeting state requirements for commercial auto insurance ensures that businesses comply with the law and avoid potential penalties or fines for inadequate coverage.

- By aligning coverage limits with state regulations, businesses can also safeguard themselves against financial liabilities in the event of accidents or lawsuits.

- Failure to meet state requirements can result in legal consequences, suspension of vehicle registrations, and other complications that may disrupt business operations.

Examples of Coverage Limits Alignment

- In California, the state requires a minimum liability coverage of $15,000 for bodily injury per person, $30,000 for bodily injury per accident, and $5,000 for property damage. Insurance companies may offer higher coverage limits based on the business's needs and risk exposure.

- In Texas, commercial auto policies must meet the state's minimum liability coverage of $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage. Businesses can opt for higher coverage limits to enhance protection.

- Business owners should carefully assess their operations, the types of vehicles used, and the potential risks involved to determine the most suitable coverage limits that comply with state requirements.

Understanding Umbrella Policies

In the context of commercial auto insurance, umbrella policies serve as an additional layer of coverage that goes beyond the standard policy limits. These policies are designed to provide extra protection in case of a catastrophic event where the standard policy limits may not be sufficient to cover all expenses.

Benefits of Umbrella Policies

- Umbrella policies can provide coverage for liability claims that exceed the limits of the primary commercial auto policy. This additional coverage can help protect businesses from financial losses in the event of a lawsuit.

- Having an umbrella policy can offer peace of mind to business owners, knowing that they have extra protection in place in case of a major accident or lawsuit.

- Umbrella policies are relatively affordable compared to the amount of coverage they provide, making them a cost-effective way to increase insurance protection for businesses.

- These policies can also help maintain the financial stability of a business by covering costs that exceed the limits of the primary policy, reducing the risk of bankruptcy or financial strain.

Final Conclusion

In conclusion, understanding the intricacies of Commercial Auto Policy Limits is vital for businesses to make informed decisions and ensure adequate coverage for their vehicles.

Questions and Answers

What factors influence the determination of policy limits?

The size and type of business, risk assessment, and coverage needs are key factors that impact policy limits.

What are the differences between single limit and split limit policies?

A single limit policy provides a combined coverage limit for all damages, while a split limit policy sets separate limits for bodily injury and property damage.

Why is it important to meet state requirements for commercial auto insurance?

Meeting state requirements ensures legal compliance and adequate coverage in case of accidents or liabilities.

How do umbrella policies enhance coverage for businesses?

Umbrella policies offer additional coverage beyond standard policy limits, providing extra protection for unforeseen circumstances.