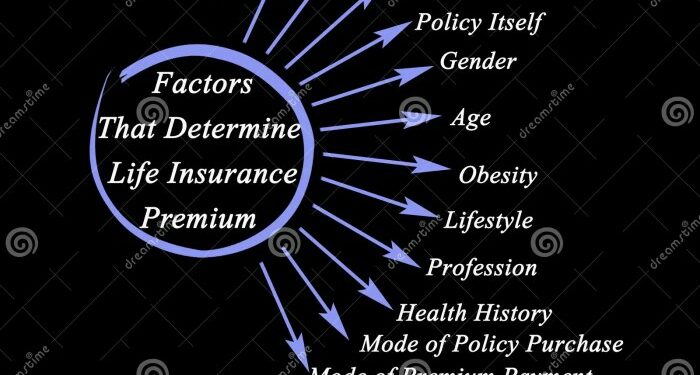

Starting with the exploration of What Factors Affect Your Life Insurance Quote the Most?, this introduction aims to grab the readers' attention and provide a preview of the key points discussed.

The following paragraphs will delve into the various aspects influencing life insurance quotes, shedding light on age, health conditions, lifestyle choices, coverage amount, policy types, and underwriting criteria.

Factors influencing life insurance quotes

Age, health conditions, and lifestyle choices are some of the key factors that significantly impact the life insurance quotes individuals receive. Let's delve into how each of these factors affects your life insurance premiums.

Age

Age plays a crucial role in determining life insurance quotes. Generally, the younger you are when you purchase a policy, the lower your premiums are likely to be. This is because younger individuals are considered less risky to insure compared to older individuals.

As you age, the risk of developing health conditions increases, leading to higher premiums to offset the potential costs for the insurance provider.

Health Conditions

Health conditions can have a significant impact on life insurance premiums. Individuals with pre-existing medical conditions such as diabetes, heart disease, or cancer may face higher premiums due to the increased risk they pose to the insurance company. Insurance providers assess the likelihood of a policyholder making a claim based on their current health status and medical history.

The presence of certain health conditions can result in higher premiums or even denial of coverage in some cases.

Lifestyle Choices

Your lifestyle choices can also influence your life insurance rates. Factors such as smoking, excessive alcohol consumption, and engaging in high-risk activities like skydiving or racing can lead to higher premiums. Insurance companies take into account these lifestyle choices as they contribute to an individual's overall risk profile.

Making healthier lifestyle choices can not only improve your overall well-being but also potentially lower your life insurance premiums.

Importance of coverage amount

When it comes to life insurance, determining the coverage amount is a critical decision that can significantly impact your premiums and the level of financial protection provided to your loved ones in the event of your passing.The coverage amount you choose directly affects your life insurance quotes.

Generally, the higher the coverage amount, the higher the premiums you will pay. This is because a higher coverage amount means the insurance company will potentially need to pay out more money to your beneficiaries upon your death.

Comparison of different coverage levels and their impact on premiums

Choosing a higher coverage amount will naturally result in higher premiums. For example, if you opt for a $1 million coverage amount, your premiums will be higher compared to someone who chooses a $500,000 coverage amount for the same policy type and term length.

Insurance companies take into account the risk involved in providing a larger payout, which is reflected in the premiums you are quoted.

Relationship between coverage amount and cost of life insurance

The relationship between coverage amount and the cost of life insurance is straightforwardthe more coverage you want, the more you will have to pay in premiums. It's important to strike a balance between the coverage amount you need to adequately protect your loved ones and the premiums you can comfortably afford.

Keep in mind that a higher coverage amount may provide greater peace of mind, but it also comes with a higher financial commitment in terms of premiums.

Influence of policy type

When it comes to life insurance, the type of policy you choose can have a significant impact on the quotes you receive. Different policy types offer varying levels of coverage, benefits, and premium rates. Let's delve into how policy type influences your life insurance quote.

Term Life Insurance vs. Whole Life Insurance

Term life insurance and whole life insurance are two common types of life insurance policies that differ in structure and cost.

- Term Life Insurance: This type of policy provides coverage for a specific period, such as 10, 20, or 30 years. Premiums are typically lower compared to whole life insurance because it offers temporary coverage without a cash value component.

- Whole Life Insurance: Whole life insurance offers coverage for the entire lifetime of the policyholder and includes a cash value component that grows over time. As a result, premiums are higher compared to term life insurance.

Other Policy Types and Their Impact on Premiums

Different policy types beyond term and whole life insurance, such as universal life insurance and variable life insurance, can also affect life insurance premiums.

- Universal Life Insurance: This type of policy offers flexibility in premium payments and death benefits. Premiums can vary based on the performance of the cash value component of the policy.

- Variable Life Insurance: Variable life insurance allows policyholders to allocate their premiums into investment accounts. The cash value and death benefits can fluctuate based on the performance of these investments, impacting premium rates.

Significance of Policy Type in Life Insurance Quotes

The choice of policy type plays a crucial role in determining life insurance quotes due to the varying levels of coverage, benefits, and premium rates associated with each type. Factors such as the duration of coverage, cash value components, and investment options can all influence the cost of premiums.

It's essential to consider your financial goals and coverage needs when selecting a policy type to ensure you receive the most suitable and affordable life insurance quote.

Underwriting criteria

When it comes to determining life insurance quotes, the underwriting process plays a crucial role. Insurers carefully assess various factors to evaluate the risk associated with insuring an individual, which ultimately impacts the premium rates offered.

Factors Evaluated in Underwriting

- Medical History: Insurers consider an individual's medical history to assess the likelihood of future health issues. Pre-existing conditions, chronic illnesses, and family medical history can influence life insurance costs.

- Lifestyle Choices: Lifestyle habits such as smoking, alcohol consumption, and participation in high-risk activities like skydiving can impact life insurance premiums. Healthier lifestyle choices often lead to lower rates.

- Age and Gender: Younger individuals typically receive lower premiums as they are considered lower risk. Additionally, women tend to have longer life expectancies and may receive more favorable rates.

- Occupation: Certain occupations that involve high levels of risk or exposure to hazardous conditions may result in higher premiums due to increased mortality risk.

- Financial Status: Insurers may also evaluate an individual's financial stability and income level to determine their ability to pay premiums consistently.

Final Review

Wrapping up our discussion on What Factors Affect Your Life Insurance Quote the Most?, this conclusion encapsulates the main takeaways and key insights highlighted throughout the content.

Commonly Asked Questions

How does age influence life insurance quotes?

Age plays a significant role in determining life insurance quotes, with younger individuals generally receiving lower premiums compared to older individuals. Insurers consider age as a factor in assessing life expectancy and risk.

What impact do health conditions have on life insurance premiums?

Health conditions can affect life insurance premiums by increasing the risk factor associated with the policyholder. Pre-existing conditions or unhealthy lifestyle choices may lead to higher premiums to compensate for the higher likelihood of claims.

How does coverage amount affect life insurance quotes?

The coverage amount directly influences life insurance quotes, as higher coverage levels result in higher premiums. Insurers assess the amount of financial protection provided by the policy when determining the cost.

What are the differences between term life insurance and whole life insurance in terms of quotes?

Term life insurance typically offers lower premiums for a specified period, while whole life insurance provides coverage for the entire lifetime but comes with higher premiums. The type of policy chosen can impact the cost of life insurance.

How does the underwriting process impact life insurance quotes?

The underwriting process, which involves assessing risks associated with the policyholder, directly affects life insurance quotes. Factors such as medical exams, lifestyle assessments, and underwriting criteria play a crucial role in determining premiums.