Exploring the components of a homeowners insurance quote, this introduction sets the stage for a detailed look at what is typically covered and excluded. With a blend of informative insights and engaging language, readers are drawn into the intricate world of insurance quotes.

As we delve deeper into the specifics, you'll gain a comprehensive understanding of the inclusions and exclusions that shape homeowners insurance quotes.

What Does a Homeowners Insurance Quote Include?

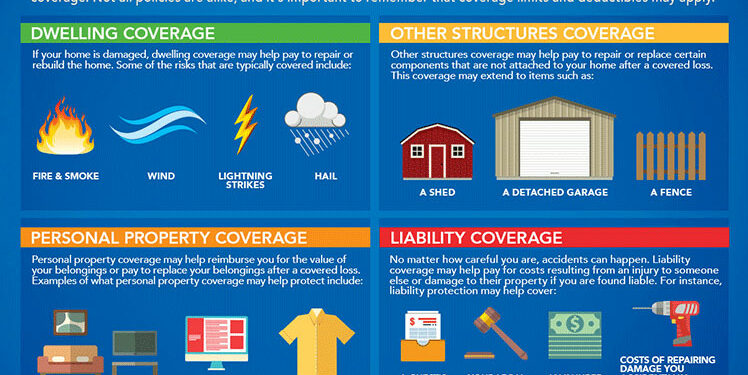

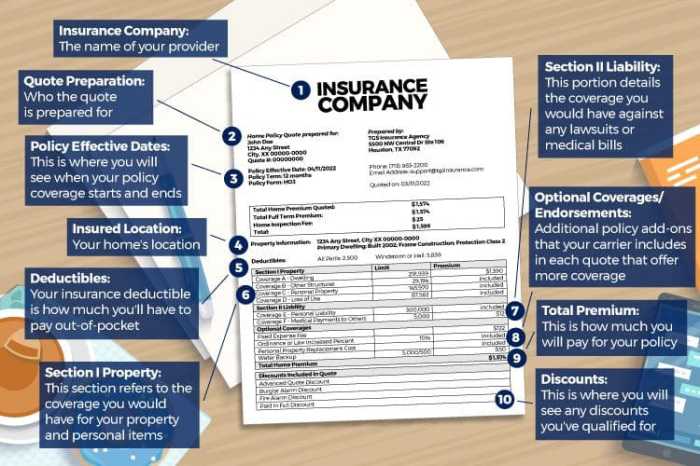

When obtaining a homeowners insurance quote, there are several key components that are typically included to provide you with a detailed overview of the coverage options available. These components help you understand what is covered and what is not in your policy.

Components of a Homeowners Insurance Quote:

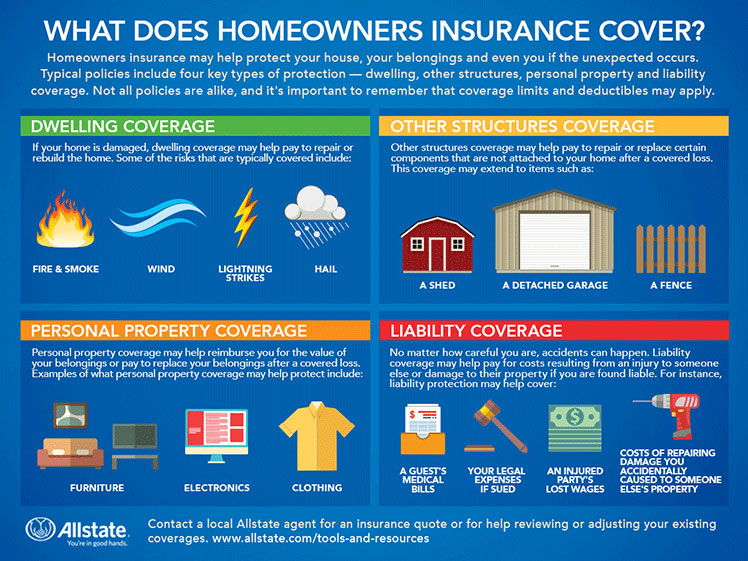

- The dwelling coverage: This includes protection for the physical structure of your home in case of damage from covered perils such as fire, wind, or vandalism.

- Personal property coverage: This covers your belongings inside the home, including furniture, clothing, and electronics, in case of theft, damage, or loss.

- Liability coverage: This protects you in case someone is injured on your property and you are found legally responsible for their injuries.

- Additional living expenses coverage: This helps cover the cost of temporary living arrangements if your home becomes uninhabitable due to a covered loss.

Coverage Options in a Standard Homeowners Insurance Quote:

- Fire and smoke damage

- Theft

- Vandalism

- Windstorm and hail

- Water damage from plumbing or appliances

- Personal liability protection

Additional Coverage in a Comprehensive Homeowners Insurance Quote:

- Flood insurance

- Earthquake insurance

- Jewelry and valuable items coverage

- Sewer backup coverage

Deductibles in a Homeowners Insurance Quote:

In a homeowners insurance quote, deductibles play a crucial role in determining how much you will pay out of pocket before your insurance coverage kicks in. Typically, a higher deductible will result in lower premiums, while a lower deductible will result in higher premiums.

What Does a Homeowners Insurance Quote Exclude?

When obtaining a homeowners insurance quote, it is crucial to understand what is excluded from the coverage. While the specifics may vary depending on the insurance provider and policy, there are common exclusions that are typically found in standard homeowners insurance quotes

Common Exclusions in a Homeowners Insurance Quote:

- Earth movement: Most policies do not cover damage caused by earthquakes, landslides, or sinkholes.

- Floods: Homeowners insurance typically does not cover damage from floods, requiring a separate flood insurance policy.

- War and nuclear hazards: Damage resulting from war, nuclear accidents, or terrorism is usually excluded.

- Normal wear and tear: Maintenance-related issues, like mold, pest infestations, or gradual deterioration, are not covered.

Reasons for Exclusions:

Insurance companies exclude certain items or events from homeowners insurance coverage for various reasons. Some exclusions are due to the high risk associated with specific perils, while others may require specialized coverage that is not included in a standard policy.

Importance of Understanding Exclusions:

Understanding what is excluded from a homeowners insurance quote is essential to ensure you have adequate coverage for potential risks. By knowing the limitations of your policy, you can make informed decisions about additional coverage options that may be necessary to protect your home and belongings.

Optional Coverage for Homeowners:

- Personal property endorsements: Additional coverage for high-value items like jewelry, art, or electronics.

- Sewer backup coverage: Protection against damage caused by sewer or drain backups.

- Identity theft protection: Coverage for expenses related to identity theft and fraud.

- Home business coverage: Insurance for home-based businesses and related liabilities.

Conclusive Thoughts

In conclusion, understanding the nuances of what a homeowners insurance quote includes and excludes is vital for making informed decisions about your coverage. This discussion sheds light on the complexities of insurance quotes, equipping you with essential knowledge moving forward.

Key Questions Answered

What does 'personal property coverage' typically include in a homeowners insurance quote?

Personal property coverage usually includes protection for belongings like furniture, clothing, and electronics in case of covered perils such as theft or fire.

Are natural disasters like floods and earthquakes covered in a standard homeowners insurance quote?

No, standard homeowners insurance typically excludes coverage for floods and earthquakes. Homeowners may need to purchase separate policies or endorsements for such disasters.

Why do insurance quotes exclude certain high-risk items or events?

Insurance providers often exclude high-risk items or events to mitigate their own financial risk. Understanding these exclusions is crucial for homeowners to assess their coverage needs accurately.

Is liability coverage included in a standard homeowners insurance quote?

Yes, liability coverage is usually a standard inclusion in homeowners insurance quotes, providing protection in case someone is injured on the property.