Exploring the Top 10 Tips to Lower Your Auto Insurance Quote Fast, this introduction sets the stage for an insightful discussion on ways to reduce insurance costs efficiently and effectively.

The following paragraphs will delve into specific strategies and insights to help you navigate the world of auto insurance with ease.

Understand Your Coverage Needs

When it comes to lowering your auto insurance quote, understanding your coverage needs is crucial. Here are some factors that determine the coverage you need and how to tailor it to your specific situation.

Factors Influencing Your Coverage Needs

- Your driving habits: If you have a long commute or frequently drive in high-traffic areas, you may need more coverage to protect yourself in case of an accident.

- Your vehicle type: The type of car you drive can also impact your coverage needs. For example, a luxury car may require more coverage than a standard sedan.

- Your financial situation: Consider how much you can afford to pay out of pocket in case of an accident. This will help determine the level of coverage you need.

Minimum Coverage Required by Law

- It's important to know the minimum coverage required by law in your state. This typically includes liability coverage to cover damages to other vehicles or property in case of an accident.

- While meeting the minimum requirements is necessary, it's also advisable to consider additional coverage options to protect yourself further.

Customizing Your Coverage

- Based on your driving habits, vehicle type, and financial situation, you can customize your coverage to meet your specific needs.

- Consider factors like comprehensive coverage for non-collision incidents, uninsured motorist coverage, and personal injury protection to enhance your protection.

Compare Insurance Quotes

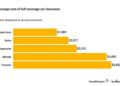

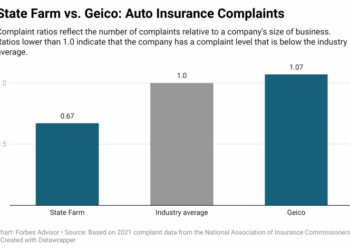

When looking to lower your auto insurance costs, comparing insurance quotes from different providers is a crucial step. By comparing quotes, you can find the best coverage options at the most competitive prices.

Importance of Comparing Coverage Limits and Deductibles

- When comparing insurance quotes, pay close attention to the coverage limits and deductibles offered by each provider. Higher coverage limits may result in higher premiums, so it's essential to strike a balance between adequate coverage and affordability.

- Similarly, adjusting your deductibles can impact your insurance costs. Opting for a higher deductible can lower your premiums, but it also means you'll have to pay more out of pocket in the event of a claim.

Bundling Policies for Cost Savings

- One effective way to lower your overall insurance costs is by bundling multiple policies with the same insurance provider. For example, combining your auto and home insurance policies can often result in significant discounts.

- Insurance companies typically offer discounts for bundling policies, making it a smart financial move to consolidate your insurance needs with one provider.

Improve Your Credit Score

Improving your credit score can have a significant impact on your auto insurance premium. Insurers often use credit scores as a factor in determining rates, with better scores typically leading to lower premiums.

How to Improve Your Credit Score

- Pay your bills on time: Timely payment of bills, including credit card bills and loans, can help improve your credit score.

- Reduce your debt: Lowering your overall debt can positively impact your credit score.

- Check your credit report: Regularly reviewing your credit report can help you identify and correct any errors that might be negatively affecting your score.

- Keep credit card balances low: Maintaining low credit card balances relative to your credit limit can improve your credit utilization ratio.

- Avoid opening multiple new accounts: Opening multiple new credit accounts in a short period can lower your average account age and negatively impact your score.

Correlation between Credit Score and Insurance Rates

A higher credit score is often associated with lower insurance rates, as it is seen as an indicator of financial responsibility. Insurers may view individuals with higher credit scores as less risky to insure, leading to lower premiums. On the other hand, individuals with lower credit scores may be charged higher rates due to the perceived higher risk.

It's essential to maintain a good credit score to potentially secure lower auto insurance quotes.

Drive Safely

Maintaining a clean driving record is crucial when it comes to lowering your auto insurance costs. Insurance companies typically offer lower premiums to drivers with a history of safe driving. By avoiding traffic violations and accidents, you can demonstrate to insurers that you are a responsible driver, which can help reduce your insurance quote.

Safe Driving Practices

- Always follow the speed limits and traffic rules to minimize the risk of accidents.

- Avoid distractions while driving, such as using your phone or eating, to stay focused on the road.

- Keep a safe distance from other vehicles to allow for enough reaction time in case of sudden stops.

- Use turn signals properly to indicate your intentions to other drivers and prevent confusion on the road.

- Regularly maintain your vehicle to ensure it is in good working condition, reducing the chances of mechanical failures while driving.

Impact of Traffic Violations and Accidents

- Accumulating traffic violations, such as speeding tickets or DUIs, can significantly increase your insurance premiums.

- Being involved in accidents, especially those where you are at fault, can also result in higher insurance costs.

- Insurance companies view drivers with a history of traffic violations and accidents as high-risk, leading to an increase in premiums to offset the perceived risk.

Opt for a Higher Deductible

Choosing a higher deductible can significantly impact your auto insurance premium. When you opt for a higher deductible, you are agreeing to pay more out of pocket in the event of a claim before your insurance coverage kicks in. This shift in financial responsibility can lead to lower monthly premiums, making it an attractive option for those looking to reduce their insurance costs.

Pros and Cons of selecting a higher deductible

- Pros:

- Lower Premiums: By choosing a higher deductible, you can enjoy reduced monthly insurance payments.

- Encourages Safe Driving: Knowing you have a higher deductible may make you more cautious on the road to avoid accidents.

- Cons:

- Higher Out-of-Pocket Costs: In the event of a claim, you will need to pay more upfront before your insurance coverage kicks in.

- Financial Strain: If you cannot afford the higher deductible when a claim arises, it may cause financial stress.

Examples of how adjusting your deductible can affect your premium

Let's say you currently have a $500 deductible on your auto insurance policy, and you decide to increase it to $1,000. As a result, your monthly premium could decrease by 15-30%, depending on the insurance provider. This means you will pay less each month for insurance but will have to cover a higher amount out of pocket if you file a claim.

Take Advantage of Discounts

When it comes to lowering your auto insurance costs, taking advantage of discounts can make a significant difference. Insurance companies often offer various discounts that can help reduce your premiums. By identifying these discounts and knowing how to qualify for them, you can potentially save a significant amount of money on your insurance.

Common Discounts Offered

- Safe Driver Discounts: Insurance companies often provide discounts to policyholders who have a clean driving record with no accidents or traffic violations. Maintaining a safe driving history can help you qualify for this discount.

- Multi-Policy Discounts: If you have multiple insurance policies with the same provider, such as auto and home insurance, you may be eligible for a multi-policy discount. Bundling your policies can lead to savings on your premiums.

- Good Student Discounts: Students who maintain a certain GPA may qualify for a good student discount. This discount is designed to reward students for their academic achievements.

Qualifying for Discounts

- Ask Your Insurance Provider: Make sure to inquire with your insurance company about the discounts they offer. They can provide you with information on the eligibility criteria and help you determine which discounts you qualify for.

- Provide Necessary Information: To qualify for certain discounts, such as a safe driver discount, ensure that your driving record is up to date and accurate. Providing the necessary documentation can help you secure the discount.

- Review Your Policy: Periodically review your insurance policy to see if there are any new discounts that you may be eligible for. As your circumstances change, you may qualify for additional discounts.

Consider Usage-Based Insurance

When it comes to lowering your auto insurance costs, considering a usage-based insurance program could be a smart move. These programs offer a more personalized approach to pricing based on your driving habits.

How Usage-Based Insurance Works

- Usage-based insurance, also known as telematics insurance, utilizes technology to track your driving behavior.

- By installing a device in your car or using a mobile app, data such as mileage, speed, braking patterns, and time of day you drive is collected.

- Insurers analyze this data to determine your risk level and calculate your premium accordingly.

Benefits of Usage-Based Insurance for Safe Drivers

- Safe drivers who exhibit good driving habits, such as obeying speed limits, avoiding hard braking, and driving during off-peak hours, are often rewarded with lower premiums.

- Usage-based insurance encourages safe driving practices, which can result in fewer accidents and lower claim costs for insurers.

- Drivers have the opportunity to improve their driving habits over time to potentially qualify for additional discounts.

Examples of How Usage-Based Insurance Can Help Lower Premiums

- For example, if you have a usage-based insurance policy and consistently demonstrate safe driving behaviors, you may see a decrease in your premium at renewal.

- Some insurers offer an initial discount just for enrolling in a usage-based program, with the potential for further savings based on your driving data.

- In the event of a claim, usage-based insurance can provide valuable information to determine fault and assess the extent of damage, potentially expediting the claims process.

Maintain a Good Driving Record

Maintaining a good driving record is crucial when it comes to lowering your auto insurance rates. Insurance companies often use your driving history to assess the level of risk you pose as a driver.When you have a clean driving record, free of accidents and traffic violations, insurance companies are more likely to offer you lower premiums.

On the other hand, if you have a history of speeding tickets, accidents, or other violations, you may end up paying higher rates for insurance coverage.

Importance of Clean Driving Record

- Insurance companies view drivers with clean records as lower risk, leading to lower premiums.

- Accidents and violations can result in increased insurance rates.

Tips for Maintaining a Clean Driving Record

- Follow speed limits and traffic laws at all times.

- Avoid distractions while driving, such as texting or using a phone.

- Attend defensive driving courses to improve your skills and knowledge.

- Regularly maintain your vehicle to prevent mechanical failures that could lead to accidents.

Review Your Coverage Regularly

It is crucial to review your auto insurance coverage regularly to ensure that you are adequately protected and getting the best value for your money. Life events such as marriage, moving, or purchasing a new vehicle can impact your insurance needs, making it essential to reassess your coverage periodically.

Adjusting Your Coverage

- When getting married, consider combining policies with your spouse to potentially qualify for multi-car discounts.

- If you have moved to a safer neighborhood, you may be eligible for lower premiums due to decreased risk of theft or accidents.

- When purchasing a new car, update your coverage to reflect the value of the vehicle and any additional features that may impact your premium.

- Review your liability limits to ensure they are sufficient to protect your assets in case of a serious accident.

- Consider adding comprehensive and collision coverage if you have an expensive car or live in an area prone to theft or natural disasters.

Seek Advice from an Insurance Agent

Consulting an insurance agent can be highly beneficial when it comes to lowering your auto insurance quote. These professionals have the expertise to help you navigate the complex world of insurance and find the best coverage options tailored to your needs.

Benefits of Consulting an Insurance Agent

- Personalized Advice: An insurance agent can assess your unique situation and provide personalized recommendations based on your specific needs.

- Access to Multiple Options: Agents work with multiple insurance providers, giving you access to a variety of coverage options to choose from.

- Expert Guidance: Insurance agents are knowledgeable about the industry and can help you understand complex insurance terms and policies.

Choosing a Reliable Insurance Agent

- Research and Recommendations: Look for agents with a good reputation and ask for recommendations from friends or family.

- Licensing and Credentials: Ensure that the agent is licensed and has the necessary credentials to provide insurance advice in your state.

- Communication and Trust: Choose an agent who communicates effectively and makes you feel comfortable discussing your insurance needs.

Wrap-Up

In conclusion, the Top 10 Tips to Lower Your Auto Insurance Quote Fast provide a roadmap to savings and better coverage. By implementing these strategies, you can take control of your insurance costs and make informed decisions for the future.

FAQ Corner

What factors determine the coverage I need?

Your coverage needs are influenced by factors such as your driving habits, vehicle type, and the minimum coverage required by law in your state.

How can I effectively compare insurance quotes?

To compare quotes, focus on coverage limits, deductibles, and consider bundling policies to lower overall costs.

Why is a good credit score important for insurance premiums?

A good credit score can positively impact your premium, so work on improving it by following some simple tips.

How does maintaining a clean driving record help in lowering insurance costs?

A clean driving record demonstrates safe driving practices, leading to lower insurance premiums.

What are some common discounts offered by insurance companies?

Common discounts include safe driver discounts and multi-policy discounts – be sure to ask your provider about available discounts.

How do usage-based insurance programs work?

Usage-based insurance programs track your driving habits to offer discounts for safe driving behaviors.

Why is it important to review your coverage regularly?

Life events and changing needs can impact your coverage, so reviewing it periodically ensures you have the right protection.

What benefits can I get from consulting an insurance agent?

An insurance agent can help you find the best coverage options and provide valuable insights for lowering your auto insurance costs.