Kicking off with Term vs Whole Life Insurance Quotes: Which Is Better for You?, this opening paragraph is designed to captivate and engage the readers, providing a clear overview of the topic.

The following paragraph will delve into the details of term life insurance, whole life insurance, and how they compare in terms of benefits and suitability.

Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. If the insured individual passes away during the term of the policy, a death benefit is paid out to the beneficiaries.

Benefits of Term Life Insurance

- Cost-effective premiums compared to whole life insurance.

- Simple and straightforward coverage with no cash value accumulation.

- Flexibility to choose the coverage amount and term length based on individual needs.

- Ability to convert to a whole life policy in some cases.

Best Suited for

- Individuals looking for temporary coverage, such as young families or those with financial obligations.

- Those seeking affordable protection for a specific period, like until children are financially independent or a mortgage is paid off.

Flexibility of Term Life Insurance

Term life insurance offers flexibility in terms of coverage amount and duration. Policyholders can choose the coverage amount that meets their needs and select a term length that aligns with their financial goals. Additionally, some term policies allow for conversion to a whole life policy, providing added flexibility for long-term planning.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which is for a specified period, whole life insurance offers lifelong protection as long as premiums are paid.

In addition to the death benefit, whole life insurance policies also have a cash value component that grows over time.

Investment Component of Whole Life Insurance Policies

Whole life insurance policies come with a cash value component that allows policyholders to accumulate savings over time. A portion of the premium paid goes towards this cash value, which grows tax-deferred. Policyholders can borrow against this cash value or use it to supplement retirement income.

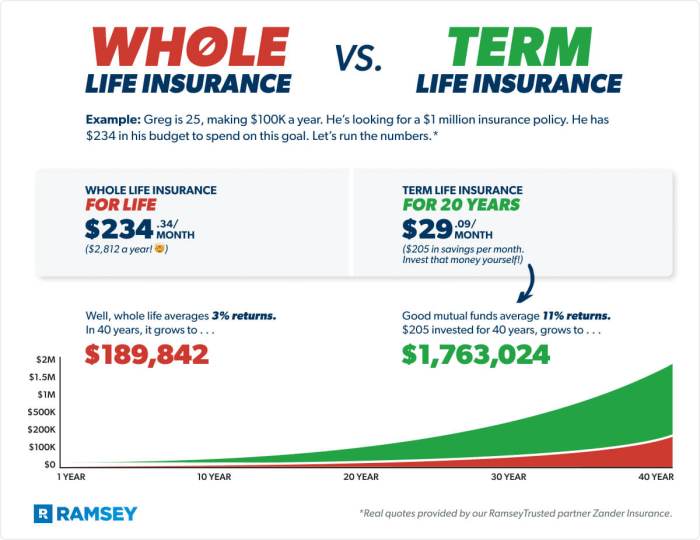

Cost Differences Between Term and Whole Life Insurance

Whole life insurance typically has higher premiums compared to term life insurance because of the lifelong coverage and cash value component. While term life insurance is more affordable initially, whole life insurance offers the benefit of coverage for a lifetime and the potential to build cash value.

Long-Term Benefits of Whole Life Insurance for Policyholders

One of the key benefits of whole life insurance is the guaranteed death benefit, which ensures that beneficiaries will receive a payout when the insured individual passes away. Additionally, the cash value component of whole life insurance policies can provide a source of savings and supplemental income in retirement.

Overall, whole life insurance offers both protection and investment benefits for policyholders.

Quotes and Premiums

When it comes to choosing between term and whole life insurance, understanding how quotes and premiums are calculated is crucial in making an informed decision. Let's delve into the details.

Term Life Insurance Quotes

- Insurance companies calculate quotes for term life insurance based on several key factors, including age, gender, health status, coverage amount, and term length.

- Younger, healthier individuals typically receive lower quotes for term life insurance, as they are considered lower risk for the insurance company.

- Term life insurance quotes are generally more affordable compared to whole life insurance, making it an attractive option for those seeking temporary coverage.

Factors Influencing Whole Life Insurance Premiums

- Premiums for whole life insurance policies are influenced by factors such as age, gender, health condition, coverage amount, cash value accumulation, and the insurer's financial stability.

- Since whole life insurance offers lifelong coverage and includes a cash value component, premiums tend to be higher compared to term life insurance.

- Insurance companies consider the risk of insuring an individual for their entire life when determining premiums for whole life insurance policies.

Comparing Quotes Effectively

- When comparing quotes from different insurance providers, be sure to consider the coverage amount, term length, additional benefits, and the financial strength and reputation of the insurer.

- Request quotes for the same coverage amount and term length to make an accurate comparison between different insurance quotes.

- Utilize online insurance comparison tools to easily compare quotes from multiple providers and choose the policy that best fits your needs and budget.

Importance of Understanding Fine Print

- It is essential to carefully review the fine print in insurance quotes to understand any exclusions, limitations, and additional fees that may impact the policy's coverage and cost.

- Pay attention to details such as renewal options, premium payment schedules, cash value growth rates, and potential policy changes over time.

- Clear understanding of the fine print will help you make an informed decision and avoid any surprises or misunderstandings in the future.

Final Conclusion

In conclusion, Term vs Whole Life Insurance Quotes: Which Is Better for You? offers valuable insights into choosing the right insurance policy based on individual needs and preferences.

General Inquiries

What factors should I consider when choosing between term and whole life insurance?

Consider factors such as budget, long-term financial goals, and coverage needs to make an informed decision.

Can I switch from term to whole life insurance later on?

Yes, it is possible to convert a term life insurance policy into a whole life insurance policy, but it may come with certain conditions and costs.

How can I ensure I am getting the best insurance quotes for my needs?

Compare quotes from different providers, review the coverage details, and consider any additional benefits or riders offered.

Is whole life insurance a good investment option?

Whole life insurance can serve as a long-term investment vehicle with cash value accumulation, but it's essential to evaluate its pros and cons.