Starting with Progressive Commercial Auto Insurance: Cost vs Value, the discussion unfolds in a captivating and distinctive manner, drawing readers into a narrative that is both intriguing and uniquely memorable.

The following paragraph will provide detailed and clear information about the topic.

Overview of Progressive Commercial Auto Insurance

Progressive Commercial Auto Insurance provides coverage for businesses that rely on vehicles for their operations. Whether you have a small business with a single vehicle or a large fleet, Progressive offers customizable policies to meet your specific needs.

Coverage Options

- Liability Coverage: Protects you in case you are at fault in an accident and covers the costs of property damage and bodily injuries to others.

- Comprehensive Coverage: Covers damages to your vehicle that are not related to a collision, such as theft, vandalism, or natural disasters.

- Collision Coverage: Pays for damages to your vehicle resulting from a collision with another vehicle or object.

- Uninsured/Underinsured Motorist Coverage: Protects you if you are involved in an accident with a driver who has insufficient insurance coverage.

Comparison with Other Providers

Progressive stands out among commercial auto insurance providers for its competitive rates, flexible coverage options, and top-notch customer service. With a focus on innovation and technology, Progressive makes it easy for businesses to manage their policies and file claims online.

Additionally, Progressive offers discounts for safe driving habits and bundling multiple policies, making it a cost-effective choice for many businesses.

Cost of Progressive Commercial Auto Insurance

When it comes to Progressive Commercial Auto Insurance, the cost can vary depending on several factors that influence the premiums. Understanding how these costs are calculated and knowing about any discounts or special offers can help businesses make informed decisions.

Factors Influencing Cost

- The type of business and industry: Certain industries may have higher risks associated with them, resulting in higher premiums.

- Driving records of employees: The driving history of employees who will be using the commercial vehicles can impact the cost of insurance.

- Type and number of vehicles: The value, make, model, and number of vehicles being insured can also affect the cost.

- Coverage limits and deductibles: Opting for higher coverage limits or lower deductibles can increase the premium cost.

- Location and use of vehicles: Where the vehicles will be operated and how frequently they will be used can impact the insurance cost.

Premium Calculation Examples

Progressive calculates commercial auto insurance premiums based on factors such as the business's location, driving records of employees, type of vehicles, and coverage limits.

Discounts and Special Offers

- Multi-policy discount: Businesses can save money by bundling their commercial auto insurance with other policies.

- Safety program discounts: Implementing safety programs or using telematics devices can qualify businesses for discounts.

- Paperless discount: Opting for electronic documents and billing can lead to additional savings on premiums.

Value of Progressive Commercial Auto Insurance

When it comes to the value of Progressive Commercial Auto Insurance, customers can expect a range of benefits that set Progressive apart in the market. From competitive rates to exceptional customer service, Progressive offers a comprehensive package that aims to meet the needs of businesses of all sizes.

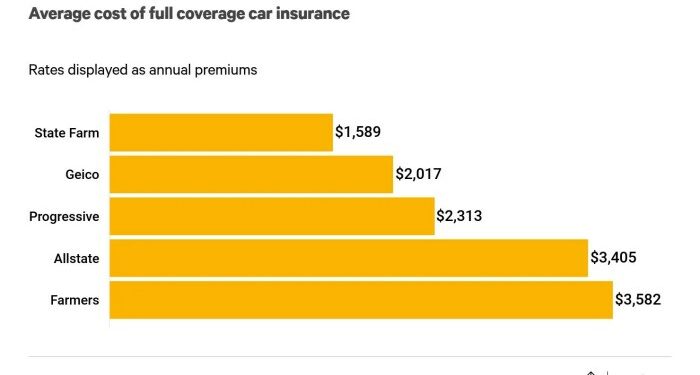

Competitive Rates

- Progressive offers competitive rates for commercial auto insurance, helping businesses save money while ensuring they have the coverage they need.

- The company provides flexible payment options and discounts for safe driving records, fleet size, and more, making it easier for businesses to manage their insurance costs.

Exceptional Customer Service

- Progressive is known for its top-notch customer service, with dedicated agents who are available to assist businesses with any insurance-related queries or claims.

- Customers appreciate the ease of communication and the quick resolution of issues when working with Progressive, enhancing the overall value of their insurance experience.

Unique Features and Benefits

- Progressive offers innovative tools such as the Snapshot program, which allows businesses to monitor their drivers' behavior and potentially lower their insurance premiums based on safe driving habits.

- With 24/7 claims reporting and a network of repair shops for expedited service, Progressive ensures that businesses can get back on the road quickly after an accident, minimizing downtime and financial losses.

Cost vs Value Analysis

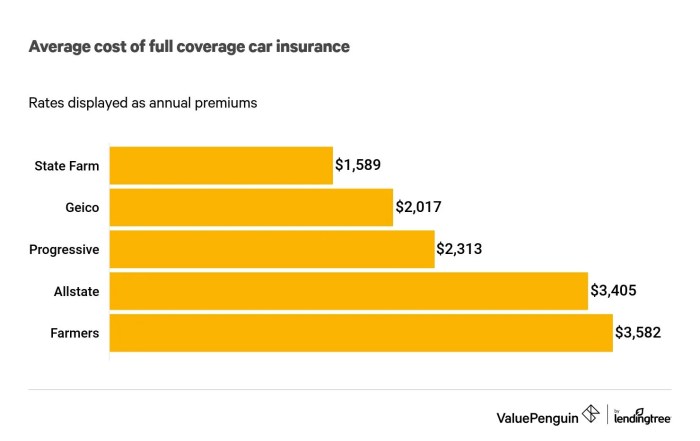

When comparing the cost-effectiveness of Progressive Commercial Auto Insurance to its competitors, it's essential to consider the value gained from investing in this coverage. Progressive offers competitive rates and a range of benefits that set it apart from other providers in the market.

Scenario 1: Small Business Owner

- Progressive Commercial Auto Insurance offers customizable plans tailored to the specific needs of small business owners. This flexibility allows businesses to only pay for the coverage they require, minimizing unnecessary costs.

- By investing in Progressive, a small business owner can benefit from 24/7 customer support, quick claims processing, and access to a network of trusted repair shops. These value-added services can save time and money in the event of an accident.

-

Progressive's competitive rates combined with comprehensive coverage make it a cost-effective choice for small businesses looking to protect their assets.

Scenario 2: Fleet Management Company

- For a fleet management company with multiple vehicles, Progressive Commercial Auto Insurance offers discounts for insuring multiple vehicles under one policy. This can result in significant cost savings for businesses with large fleets.

- Additionally, Progressive's telematics program provides insights into driver behavior, helping companies improve safety and reduce the risk of accidents. This proactive approach can lead to lower insurance premiums over time.

-

By balancing the cost of insurance with the value of risk management tools and discounts, fleet management companies can make an informed decision that benefits their bottom line.

Final Thoughts

Concluding the conversation with a summary and final thoughts presented in an engaging manner.

FAQ Corner

What factors influence the cost of Progressive Commercial Auto Insurance?

Factors such as driving record, type of vehicle, and coverage level can impact the cost of Progressive Commercial Auto Insurance.

Are there any special discounts offered by Progressive for commercial auto insurance?

Progressive may offer discounts for safe driving records, bundling policies, or having multiple vehicles insured.

How can businesses determine the balance between cost and value when selecting commercial auto insurance?

Businesses can evaluate the coverage options, customer reviews, and unique features offered by insurers to determine the best value for their specific needs.