How to Sell a Car with an Outstanding Loan Balance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Selling a car with an outstanding loan balance can be a challenging but manageable process, requiring careful consideration and planning to ensure a successful transaction.

Understanding the Loan Balance

When selling a car with an outstanding loan balance, it's crucial to understand what this means and how it impacts the selling process. An outstanding loan balance refers to the amount of money that you still owe on your car loan.

This outstanding balance needs to be paid off in full before you can transfer ownership of the vehicle to the new buyer.

Key Factors to Consider

- Remaining Loan Amount: Before selling the car, you need to determine the exact amount left on your loan. This can be obtained by contacting your lender or checking your loan statement.

- Selling Price vs. Loan Balance: Compare the selling price you expect to get for the car with the remaining loan balance. If the selling price is less than the loan balance, you will need to cover the difference out of pocket.

- Contacting the Lender: Inform your lender about your intention to sell the car. They will provide guidance on how to proceed and ensure that the loan is fully paid off during the sale process.

- Transfer Process: Work with the buyer and your lender to facilitate a smooth transfer of ownership. The buyer may need to pay the lender directly to settle the outstanding balance before taking possession of the vehicle.

Contacting the Lender

When selling a car with an outstanding loan balance, it is crucial to contact the lender to inform them of your intention to sell the vehicle. This step helps in ensuring a smooth transition of ownership and handling of the remaining loan amount.

Steps to Communicate with the Lender

- Call the lender: Reach out to the lender via phone to discuss your plans to sell the car. Provide them with all the necessary details such as the buyer's information, sale price, and the expected timeline.

- Submit a written request: Follow up your phone call with a written request detailing the sale of the car. Include all relevant information and ask for instructions on how to proceed with the loan payoff.

- Coordinate with the buyer: Work closely with the buyer to ensure they are aware of the loan balance and are prepared to handle the necessary paperwork for the transfer of ownership.

Potential Outcomes

- The lender may provide a payoff amount: Once you have informed the lender of the sale, they will calculate the remaining loan balance and provide you with a payoff amount. This amount needs to be settled before the transfer of ownership can take place.

- Transfer of title: After clearing the loan balance, the lender will release the lien on the car, allowing you to transfer the title to the new owner smoothly.

- Penalties or fees: In some cases, there may be penalties or fees associated with paying off the loan early. Make sure to clarify with the lender if any additional costs apply.

Determining the Selling Price

Determining the selling price of a car with an outstanding loan balance can be a bit tricky, but it's essential to ensure that you cover the loan amount and still make a profit. Here's how you can calculate the selling price, set a competitive yet profitable price, and negotiate with potential buyers.

Calculating the Selling Price

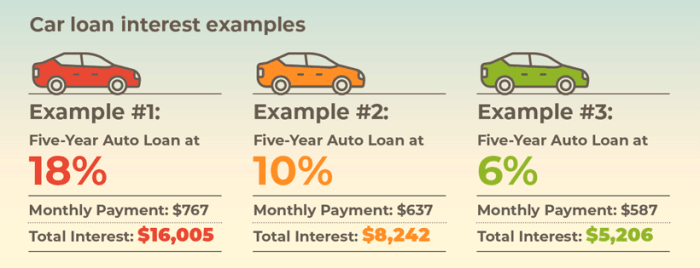

To calculate the selling price of your car with an outstanding loan balance, you need to consider the remaining loan amount, any additional fees or charges, and the market value of your car. Start by contacting your lender to get the exact payoff amount, including any penalties for early payment.

Once you have this figure, you can add it to the current market value of your car to determine the total amount you need to cover with the sale.

Setting a Competitive Price

When setting the selling price, it's crucial to strike a balance between covering your loan balance and attracting potential buyers with a competitive price. Research the current market value of your car based on its make, model, year, condition, and mileage.

Consider pricing your car slightly below the market value to make it more appealing to buyers while still ensuring you can cover the outstanding loan amount.

Negotiating with Potential Buyers

When negotiating the selling price with potential buyers, be prepared to justify your asking price based on the car's condition, maintenance history, and any added value. Highlight any recent repairs or upgrades that can increase the car's value and justify a higher price.

Be open to reasonable offers but stand firm on the minimum price you need to cover the loan balance. Remember to negotiate respectfully and be willing to walk away if the buyer's offer is too low.

Handling the Sale Process

When selling a car with an outstanding loan balance, there are specific steps and documentation needed to ensure a smooth transaction and loan closure. It is essential to follow these guidelines carefully to avoid any issues with transferring ownership and paying off the remaining loan balance.

Paperwork and Documentation

- Gather all relevant paperwork, including the vehicle title, loan documents, maintenance records, and any other pertinent information.

- Contact your lender to obtain a payoff amount and discuss the necessary steps for selling the car with an outstanding loan balance.

- Prepare a bill of sale that clearly Artikels the terms of the sale, including the selling price, any additional agreements, and the condition of the vehicle.

- Complete any transfer of ownership forms required by your state's Department of Motor Vehicles (DMV) to legally transfer the title to the buyer.

Transferring Ownership to the Buyer

- Once you have found a buyer, sign the title over to them and provide them with a copy of the bill of sale for their records.

- Notify your lender of the impending sale and coordinate with them to ensure that the loan is paid off promptly after the sale is finalized.

- Accompany the buyer to the DMV to complete the transfer of ownership and ensure that all necessary paperwork is submitted correctly.

Managing the Payment Process

- Ensure that the buyer pays the agreed-upon selling price in full before finalizing the sale and transferring ownership of the vehicle.

- If the buyer is obtaining financing for the purchase, make sure that the lender pays off the remaining loan balance directly to your current lender to close the loan.

- Once the payment is received, contact your lender to confirm the payoff amount and ensure that the loan is closed correctly, with no remaining balance.

Dealing with Negative Equity

Negative equity occurs when the outstanding loan balance on a car is higher than its current market value, which can pose challenges when selling the vehicle. It can impact the seller by requiring them to pay the difference between the loan balance and the selling price out of pocket.

Options for Addressing Negative Equity

- Roll Over Negative Equity: Some sellers choose to roll over the negative equity into a new loan when purchasing another vehicle. However, this can lead to a cycle of debt if not managed properly.

- Pay Off the Difference: Sellers can also choose to pay off the negative equity with cash or by taking out a personal loan. This option can help clear the debt and simplify the selling process.

- Negotiate with the Buyer: Sellers can try to negotiate with the buyer to cover the negative equity as part of the selling price. This approach may require flexibility and compromise from both parties.

Tips for Minimizing the Financial Impact of Negative Equity

- Research the Market: Understand the current market value of your car to set a realistic selling price that can help minimize the negative equity.

- Improve the Vehicle's Condition: Performing minor repairs or enhancements can increase the resale value of the car, potentially reducing the negative equity.

- Consider Refinancing Options: Explore refinancing the loan or transferring it to a new owner to alleviate the burden of negative equity during the sale.

Conclusive Thoughts

In conclusion, navigating the sale of a car with an outstanding loan balance involves understanding the complexities of loan balances, communicating effectively with lenders, determining fair selling prices, handling paperwork diligently, and addressing negative equity. By following the steps Artikeld in this guide, sellers can confidently navigate this process and achieve a successful sale.

FAQ

What is negative equity and how does it affect selling a car with an outstanding loan balance?

Negative equity occurs when the outstanding loan balance on a car is higher than its market value, impacting the selling process by requiring additional funds to close the loan. To address this, sellers can consider options like rolling over negative equity into a new loan or paying the difference out of pocket.

Why is it important to contact the lender when selling a car with an outstanding loan balance?

Contacting the lender is crucial to inform them of the sale and coordinate the loan closure process, ensuring a smooth transition of ownership and loan settlement. Failure to involve the lender can lead to complications in transferring the title and finalizing the sale.

How do you calculate the selling price of a car with an outstanding loan balance?

To determine the selling price, subtract the outstanding loan balance from the car's market value. This difference represents the equity that can be used towards the sale. Consider factors like the vehicle's condition, mileage, and market demand to set a competitive yet profitable selling price.