Embarking on the journey of understanding your homeowners insurance quote, this article aims to demystify the complexities and empower you with the knowledge needed to navigate the world of insurance with confidence.

Delving into the intricacies of coverage details, deciphering premium costs, understanding deductibles, and reviewing endorsements and riders, we equip you with the tools to make informed decisions about your insurance needs.

Understanding Your Homeowners Insurance Quote

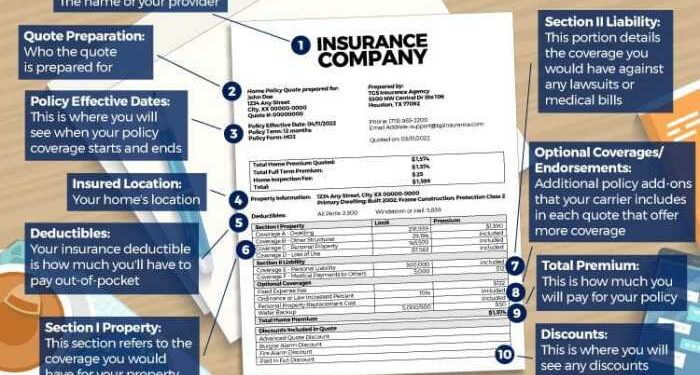

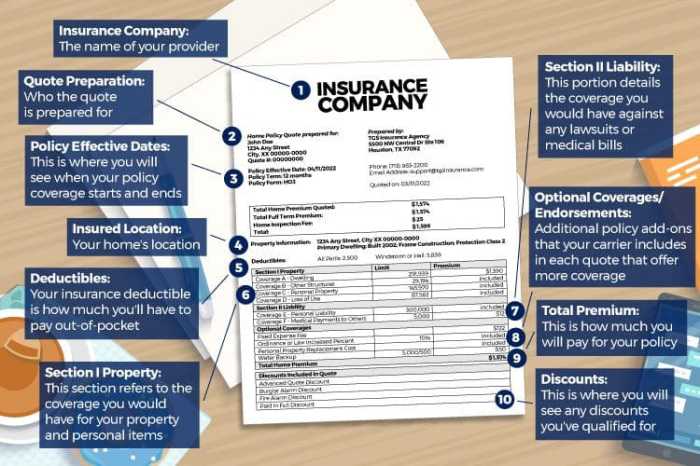

When reviewing your homeowners insurance quote, it's essential to understand the key components that are typically included. This will help you make informed decisions about your coverage and ensure that you are adequately protected in case of any unforeseen events.

Components of a Homeowners Insurance Quote

- Premiums: This is the amount you pay for your insurance coverage. It can vary based on factors such as the size and location of your home, the coverage limits you choose, and your deductible.

- Deductibles: This is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. A higher deductible usually means lower premiums, but you'll have to pay more upfront in case of a claim.

- Coverage Limits: These specify the maximum amount your insurance company will pay for covered losses. It's crucial to ensure that your coverage limits are sufficient to protect your home and belongings adequately.

- Endorsements: These are additional coverages that you can add to your policy for specific risks or items not included in standard homeowners insurance. Examples include coverage for expensive jewelry, fine art, or home businesses.

Reviewing Your Quote for Accuracy

When you receive your homeowners insurance quote, take the time to review each section carefully to ensure accuracy and completeness. Make sure that all the information about your home, belongings, and desired coverage is correct. Any discrepancies could lead to issues when filing a claim in the future.

If you have any questions or concerns, don't hesitate to reach out to your insurance agent for clarification.

Interpreting Coverage Details

Understanding the coverage details in your homeowners insurance quote is crucial to ensure you have the right protection for your property and belongings.

Common Coverage Types

- Dwelling Coverage: This type of coverage protects the physical structure of your home in case of damage from covered perils like fire, wind, or vandalism.

- Personal Property Coverage: This coverage helps replace or repair your personal belongings inside your home, such as furniture, electronics, and clothing, if they are damaged or stolen.

Implications of Coverage Limits and Exclusions

- Coverage Limits: The coverage limits in your policy determine the maximum amount your insurance company will pay for a covered claim. It's essential to review these limits to ensure they meet your needs.

- Exclusions: Exclusions are specific situations or perils that are not covered by your homeowners insurance policy. Understanding these exclusions is important to know what risks are not protected.

Additional Coverage Options

- Flood Insurance: Flood damage is typically not covered by standard homeowners insurance, so you may need to purchase a separate flood insurance policy to protect your home and belongings from flooding.

- Earthquake Insurance: Similarly, earthquake damage is usually not covered by standard policies, so earthquake insurance is a separate coverage option you may need to consider if you live in a high-risk area.

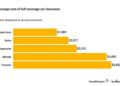

Deciphering Premium Costs

Understanding how homeowners insurance premiums are calculated is essential in determining the overall cost of your policy. Several factors influence the cost of premiums, such as the level of coverage you choose, the location of your home, the age and condition of your property, and your claim history.

It's important to compare different levels of coverage to see how they impact the premium amounts in your quote.

Factors Influencing Premium Costs

- The level of coverage you select directly affects the premium amount. Higher coverage limits and additional coverage options will result in higher premiums.

- The location of your home plays a significant role in determining your premium. Homes located in areas prone to natural disasters or high crime rates may have higher premiums.

- The age and condition of your property can impact your premium. Older homes or properties in poor condition may cost more to insure.

- Your claim history is also considered when calculating premiums. A history of frequent claims may result in higher premiums.

Comparing Coverage Levels

- When comparing different levels of coverage, higher coverage limits will typically increase the premium amount. However, opting for lower coverage limits may leave you underinsured in case of a claim.

- Add-on coverages, such as personal property or liability coverage, will also affect premium costs. Consider your individual needs and risks when selecting coverage options.

Discounts and Credits

- Insurance companies offer various discounts or credits that can help lower your premium. Examples include bundling your homeowners and auto insurance, having a home security system, or being a non-smoker.

- These discounts or credits are reflected in your quote as reduced premium amounts. Be sure to inquire about available discounts when obtaining your homeowners insurance quote.

Understanding Deductibles

When it comes to homeowners insurance, a deductible is the amount of money you are responsible for paying out of pocket before your insurance coverage kicks in. Understanding deductibles is crucial as it directly impacts your insurance costs and how much you will need to pay in the event of a claim.

How Deductibles Work in Homeowners Insurance

- Your deductible amount is specified in your homeowners insurance quote, usually in a dollar figure such as $500, $1,000, or more.

- For example, if you have a $1,000 deductible and file a claim for $5,000 in damages, you would need to pay the first $1,000, and your insurance would cover the remaining $4,000.

- Choosing a higher deductible typically results in lower insurance premiums, but it also means you will have to pay more out of pocket in case of a claim.

Choosing the Right Deductible Amount

When deciding on the deductible amount for your homeowners insurance, consider your personal financial situation. Here are some factors to keep in mind:

- Assess your ability to cover the deductible in the event of a claim. Choose an amount that you can comfortably afford to pay out of pocket.

- Consider how often you may need to file a claim. If you have a higher likelihood of filing claims, a lower deductible may be more suitable.

- Evaluate the impact of your deductible on your insurance premiums. Balancing your deductible amount with your premium costs is crucial for finding the right coverage.

Reviewing Endorsements and Riders

When reviewing your homeowners insurance quote, it is crucial to understand the role of endorsements and riders in customizing your coverage to suit your specific needs. Endorsements and riders are additional provisions that can be added to your policy to enhance or modify your coverage.

Differentiating Endorsements and Riders

Endorsements and riders are terms often used interchangeably, but they have slight differences in the insurance world. Endorsements refer to changes made to the standard policy, while riders are additional coverage options that can be attached to the policy for an extra cost.

Both endorsements and riders provide added protection beyond what is included in the basic policy.

- Common endorsements or riders that may be listed in your insurance quote:

- Water Backup Coverage: Protects against damage caused by water backing up through sewers or drains.

- Scheduled Personal Property Coverage: Covers specific high-value items, such as jewelry or art, that exceed standard limits.

- Identity Theft Coverage: Helps cover expenses related to identity theft, such as legal fees and lost wages.

Customizing Your Coverage with Endorsements and Riders

Adding or removing endorsements to your policy allows you to tailor your coverage to meet your individual needs. To add an endorsement or rider, you typically need to contact your insurance provider and request the specific changes. Keep in mind that adding endorsements or riders may result in an increase in your premium, but it can provide valuable protection where you need it most.

Comparing Quotes from Different Insurers

When comparing homeowners insurance quotes from different insurers, it's important to consider several key factors to ensure you are getting the best coverage for your needs at a competitive price.

Varying Coverage Levels, Deductibles, and Endorsements

- Each insurance provider may offer different coverage levels for various aspects of your policy, such as dwelling coverage, personal property coverage, and liability protection. It's essential to review these details carefully to understand what is included in each quote.

- Deductibles can vary between quotes, impacting how much you will pay out of pocket before your coverage kicks in. Be sure to compare deductibles across quotes and consider how they align with your budget and risk tolerance.

- Endorsements and riders are additional coverages that you can add to your policy for extra protection. Quotes may differ in the endorsements offered or included, so it's crucial to evaluate these options and their costs.

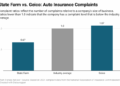

Evaluating Overall Value and Reputation

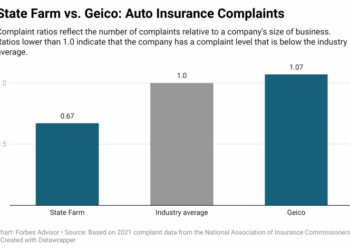

- Look beyond the quoted price and consider the overall value of the policy. This includes the coverage provided, customer service reputation, claims process efficiency, and financial stability of the insurance company.

- Check customer reviews and ratings to get insights into the experiences of policyholders with each insurer. A company with a solid reputation for customer satisfaction and prompt claims handling may be worth paying a slightly higher premium for.

- Research the financial strength of the insurance companies you are considering by checking their ratings from independent agencies like A.M. Best, Standard & Poor's, or Moody's. A financially stable insurer is more likely to fulfill its obligations and pay claims when needed.

Closing Notes

In conclusion, grasping the nuances of your homeowners insurance quote is crucial to ensuring you have the right coverage to protect your home and belongings. By carefully examining each element of the quote, you can make informed choices that align with your financial goals and risk tolerance.

Expert Answers

What are some key components typically found in a homeowners insurance quote?

The key components usually include premiums, deductibles, coverage limits, and any additional endorsements.

How do coverage limits and exclusions impact my policy?

Coverage limits determine the maximum amount your policy will pay, while exclusions specify what is not covered by your insurance.

Are flood insurance and earthquake insurance options that can be listed in the quote?

Yes, additional coverage options like flood insurance or earthquake insurance may be presented in the quote.

How can different levels of coverage affect premium amounts?

Higher levels of coverage typically result in higher premiums, while lower coverage levels may lead to lower premiums.

What is the process for adding or removing endorsements to customize your coverage?

You can usually add or remove endorsements by contacting your insurance provider and making the necessary adjustments to your policy.