Auto Insurance Quote vs Estimate: What’s the Difference? sets the stage for a comprehensive look into the distinctions between these two crucial aspects of insurance evaluation. Dive into this informative piece that promises to enlighten you on the nuances of auto insurance pricing.

In the subsequent paragraphs, we will delve into the specifics of auto insurance quotes and estimates, shedding light on their differences and importance in the insurance realm.

Understanding Auto Insurance Quote

When it comes to auto insurance, an insurance quote is an estimate of how much you will need to pay for your coverage based on the information you provide to an insurance company. It is not a binding agreement but rather an initial offer that Artikels the cost and details of the insurance policy.

Information Included in an Auto Insurance Quote

- Your personal information, such as age, location, driving record, and credit score.

- Details about your vehicle, including make, model, year, and safety features.

- The type and level of coverage you are requesting, such as liability, comprehensive, or collision.

- Any discounts you may qualify for, such as safe driver discounts or multi-policy discounts.

How Auto Insurance Quotes are Calculated

Auto insurance quotes are calculated based on a variety of factors, including the risk associated with insuring you as a driver and the likelihood of you filing a claim. Insurance companies use complex algorithms that take into account your driving history, the type of car you drive, your location, and other relevant details to determine your quote.

The Importance of Obtaining Multiple Quotes

It is crucial to shop around and obtain multiple auto insurance quotes before making a decision. By comparing quotes from different insurance companies, you can ensure that you are getting the best coverage at the most competitive price. This allows you to make an informed decision and choose a policy that meets your needs and budget.

Exploring Auto Insurance Estimate

When it comes to auto insurance, an estimate refers to a rough calculation of the potential cost of insurance coverage based on limited information provided by the applicant. Unlike a quote, an estimate is not a firm offer from the insurance company but rather a preliminary assessment.

Differentiating Between Insurance Quote and Estimate

- An insurance quote is a precise offer from the insurance company based on detailed information provided by the applicant, including driving history, vehicle details, and coverage preferences.

- On the other hand, an estimate is a rough calculation based on limited information and may not accurately reflect the final cost of insurance.

Situations Where an Estimate may be Used Instead of a Quote

In situations where the applicant is unsure about specific details or wants to get a general idea of the potential cost of insurance without providing extensive information, an estimate may be used. This can be helpful for individuals who are just exploring their options and not ready to commit to a specific policy.

Accuracy of Estimates Compared to Quotes

- Estimates are typically less accurate than quotes since they are based on limited information. They may not take into account important factors that can impact the final cost of insurance, such as driving record, credit score, or specific coverage needs.

- While estimates can provide a general idea of the potential cost of insurance, they should not be relied upon as the final price. It's essential to obtain a detailed quote from the insurance company to get an accurate picture of the actual cost of coverage.

Factors Influencing Quotes and Estimates

When it comes to determining the price of auto insurance, several factors come into play. These factors can significantly influence the quotes provided by insurance companies and the estimates calculated for potential policyholders.

Factors Influencing Auto Insurance Quotes

- Driving History: A driver's past record, including accidents, traffic violations, and claims history, can heavily impact the insurance quote. A clean driving record usually results in lower premiums.

- Age and Gender: Younger drivers and males statistically pose higher risks, leading to higher insurance quotes.

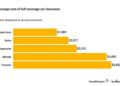

- Vehicle Type: The make, model, year, and safety features of the car being insured can affect the cost of insurance.

- Location: Where the driver lives and parks the vehicle plays a role in determining insurance quotes.

Factors Influencing Auto Insurance Estimates

- General Information: Estimates are often based on broad information provided by the individual and may not be as specific as quotes.

- Range of Coverage: Estimates may provide a ballpark figure based on the desired coverage options without delving into detailed specifics.

- Assumptions: Estimates may involve assumptions about the individual's driving habits and history rather than concrete data.

Examples of Variables Impacting Insurance Costs

- Annual Mileage: The number of miles driven per year can influence insurance costs, with higher mileage typically leading to higher premiums.

- Credit Score: In some states, credit history can affect insurance rates, as individuals with lower credit scores may be considered higher risk.

- Deductible Amount: The deductible chosen by the policyholder can impact both the quote and estimate provided by insurance companies.

Role of Driving Record in Quotes and Estimates

The individual's driving record is a crucial factor in determining both insurance quotes and estimates. A history of accidents or traffic violations can lead to higher premiums, while a clean record can result in more affordable rates.

Obtaining Quotes and Estimates

When it comes to obtaining auto insurance quotes and estimates, accuracy is key. Providing precise information ensures that you receive the most relevant and realistic pricing for your insurance needs.

How to Get Accurate Auto Insurance Quotes

Here are some tips to help you get accurate auto insurance quotes:

- Provide detailed information about your vehicle, driving history, and any additional drivers.

- Be honest about your mileage, where you park your car, and any modifications made to the vehicle.

- Consider bundling policies or asking about available discounts for a more comprehensive quote.

- Shop around and compare quotes from multiple insurance providers to ensure you are getting the best deal.

Importance of Providing Accurate Information

It is crucial to provide accurate information when requesting a quote or estimate as any discrepancies could lead to incorrect pricing or coverage. Insurance companies base their quotes on the information provided, and inaccuracies can result in unexpected costs or denied claims.

Requesting and Comparing Quotes

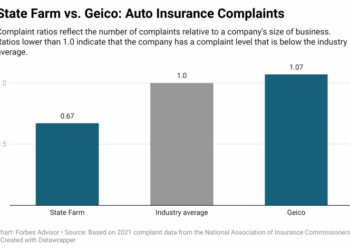

When requesting quotes from different insurance providers, make sure to provide identical information to each company for a fair comparison. This includes the same coverage limits, deductibles, and details about your vehicle and driving history. Use this information to compare pricing, coverage options, and customer reviews before making a decision.

Using Online Tools for Quotes and Estimates

Online tools make it easy to generate quotes and estimates quickly. By entering your information into these tools, you can receive instant pricing from multiple providers without the hassle of calling each one individually. Remember to review the details carefully and reach out to the insurance company directly if you have any questions or need further clarification.

Epilogue

As we wrap up our discussion on Auto Insurance Quote vs Estimate: What’s the Difference?, it becomes evident that grasping these distinctions can empower you to make informed decisions when it comes to choosing the right insurance coverage. Stay informed, stay secure.

Essential FAQs

What is the main difference between an auto insurance quote and an estimate?

An auto insurance quote is a precise offer from an insurance provider based on specific details, while an estimate is a rough calculation that may not be as accurate.

When should I opt for an auto insurance estimate instead of a quote?

An estimate is typically used when quick calculations are needed or when detailed information for a quote is not readily available.

How can I ensure I receive accurate auto insurance quotes?

Providing precise and up-to-date information to insurance providers is crucial to obtaining accurate quotes tailored to your needs.