Auto Insurance Deductibles Explained: What You Should Know sets the stage for this informative narrative, offering readers insights into the complexities of auto insurance deductibles in a clear and engaging manner.

The following paragraphs will delve deeper into the nuances of auto insurance deductibles, providing a comprehensive understanding of this crucial aspect of insurance policies.

Overview of Auto Insurance Deductibles

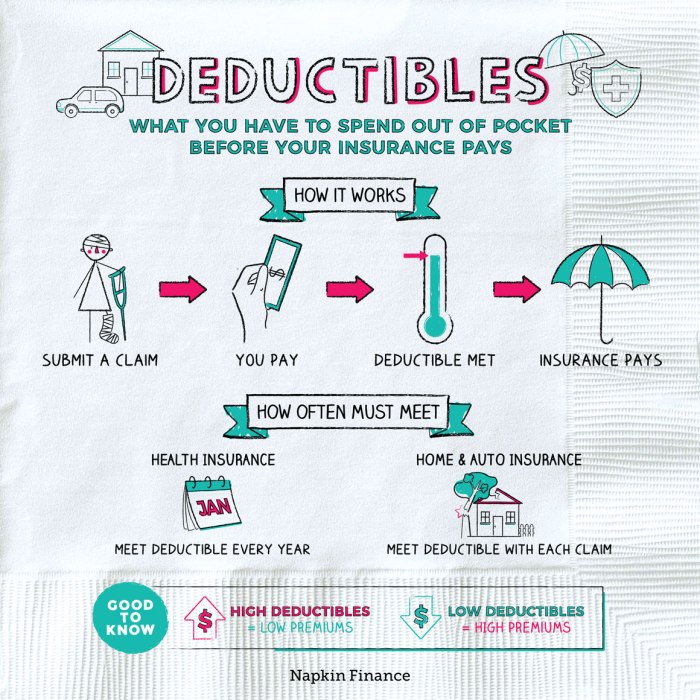

An auto insurance deductible is the amount of money you agree to pay out of pocket towards a claim before your insurance coverage kicks in. It is a key component of your auto insurance policy and can have an impact on your premiums and coverage options.

Definition and Purpose

Auto insurance deductibles serve as a way to share the risk between you and your insurance provider. By requiring you to pay a portion of the claim, deductibles help keep insurance costs lower for both parties.

- Auto insurance deductibles are typically set at specific amounts, such as $500 or $1,000, but can vary depending on your policy and insurer.

- Choosing a higher deductible can lower your premium, while a lower deductible may result in higher premiums.

- Having a deductible encourages responsible driving and discourages small or unnecessary claims.

Types of Auto Insurance Deductibles

When it comes to auto insurance deductibles, there are different types that policyholders can choose from based on their preferences and financial situations. Understanding the pros and cons of each type is crucial in making an informed decision that best suits individual needs.

Let's explore some common types of auto insurance deductibles and how they can impact insurance premiums.

Fixed Deductible

A fixed deductible is a set amount that the policyholder is responsible for paying out of pocket before the insurance coverage kicks in. For example, if you have a $500 fixed deductible and you file a claim for $2000 in damages, you would need to pay $500 while the insurance company covers the remaining $1500.

- Pros:

- Straightforward and easy to understand.

- Predictable costs in the event of a claim.

- Cons:

- Higher deductibles can lead to higher out-of-pocket expenses.

- May result in higher insurance premiums to offset lower deductibles.

Percentage-Based Deductible

A percentage-based deductible is calculated as a percentage of the total claim amount rather than a fixed dollar amount. For instance, if you have a 10% deductible and file a claim for $3000, you would be responsible for paying $300 (10% of $3000) while the insurance covers the remaining $2700.

- Pros:

- Can be more cost-effective for higher-value claims.

- Allows for flexibility based on the claim amount.

- Cons:

- Can lead to unpredictable out-of-pocket expenses.

- May result in higher premiums for lower percentage deductibles.

Choosing a higher deductible typically results in lower insurance premiums, as the policyholder assumes more financial responsibility in the event of a claim. On the other hand, opting for a lower deductible means higher premiums but lower out-of-pocket costs at the time of a claim.

It's essential to evaluate personal financial capabilities and risk tolerance when deciding on the type of auto insurance deductible that aligns with individual needs and budget constraints.

Factors Influencing Auto Insurance Deductibles

When it comes to auto insurance deductibles, several factors can influence the cost you pay. Understanding these factors can help you make informed decisions about your coverage and potentially lower your deductible amounts.

Driving Record

Your driving record plays a significant role in determining your auto insurance deductible. If you have a history of accidents or traffic violations, insurance companies may consider you a higher risk driver, leading to higher deductible amounts. On the other hand, a clean driving record can result in lower deductibles as you are seen as a safer driver.

Location

Where you live can also impact your auto insurance deductible. Urban areas with higher rates of accidents or theft may result in higher deductibles compared to rural areas with lower risks. Insurance companies take into account the likelihood of claims based on your location, so it's essential to consider this factor when choosing your deductible.

Vehicle Type

The type of vehicle you drive can affect your auto insurance deductible as well. High-performance cars or luxury vehicles may have higher deductibles due to the increased cost of repairs or replacements. On the other hand, safer and more affordable cars may result in lower deductible amounts.

When selecting a vehicle, keep in mind how it can impact your insurance costs.

Tips to Lower Auto Insurance Deductibles

- Maintain a clean driving record to demonstrate responsible driving behavior.

- Consider increasing your deductible amount to lower your premium costs.

- Install safety features in your vehicle to reduce the risk of accidents or theft.

- Bundle your auto insurance with other policies to qualify for discounts.

- Shop around and compare quotes from different insurance companies to find the best deal for your needs.

Claims Process and Auto Insurance Deductibles

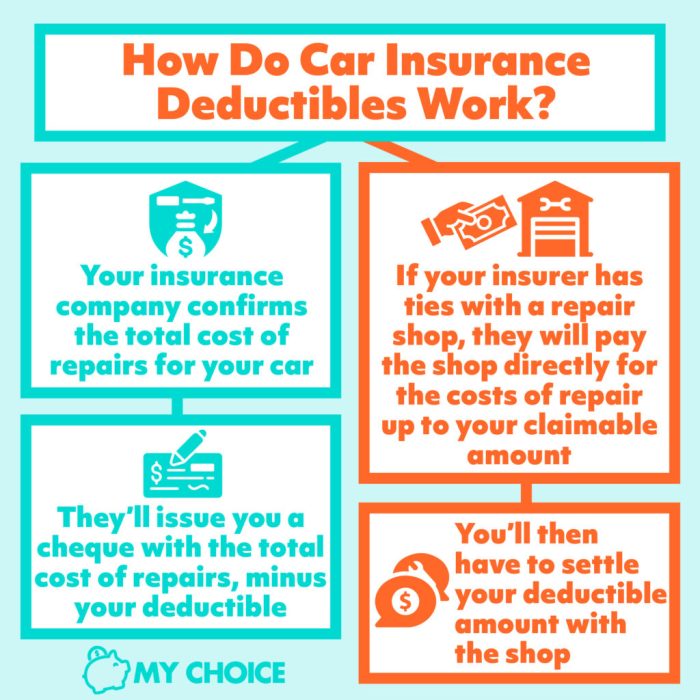

When it comes to filing a claim with your auto insurance deductible, there are specific steps you need to follow to ensure a smooth process. Understanding how the deductible is applied and when it comes into play is crucial for making informed decisions about your coverage.

Let's delve into the details.

How the Deductible is Applied

- Once you file a claim with your auto insurance company, the deductible amount you agreed upon when purchasing your policy will be deducted from the total amount of the claim payout.

- For example, if you have a $500 deductible and your claim is for $2,000, you would be responsible for paying the $500 deductible, and your insurer would cover the remaining $1,500.

- It's essential to remember that the deductible is the amount you agree to pay out of pocket towards a claim before your insurance coverage kicks in.

Scenarios Where Deductibles May or May Not Apply

- Deductibles typically apply to comprehensive and collision coverage claims but may not apply to liability claims where you are not at fault.

- If your car is damaged in a hit-and-run accident, you may need to pay your deductible for the repairs unless your policy includes uninsured motorist coverage that waives the deductible in such cases.

- On the other hand, if your windshield gets chipped and you have comprehensive coverage with a specific glass deductible, you may have a separate, lower deductible for glass repairs that would apply in this scenario.

Final Wrap-Up

In conclusion, Auto Insurance Deductibles Explained: What You Should Know sheds light on the intricacies of deductibles, empowering readers to make informed decisions when navigating the world of auto insurance.

Query Resolution

What factors can influence the cost of auto insurance deductibles?

Factors such as driving record, location, and vehicle type can impact deductible amounts. Implementing safety features in your vehicle can potentially lower deductibles.

How does choosing a higher or lower deductible affect insurance premiums?

Opting for a higher deductible typically lowers insurance premiums but increases out-of-pocket expenses in the event of a claim. Choosing a lower deductible results in higher premiums but lower immediate costs for claims.