When it comes to choosing the right commercial auto insurance provider, the decision between Geico and State Farm can be challenging. Both companies offer unique features and pricing structures that cater to different needs. Let's delve into the details of Geico Commercial Auto Insurance vs State Farm Comparison to help you make an informed choice.

Introduction to Geico Commercial Auto Insurance and State Farm

Geico Commercial Auto Insurance and State Farm are two well-known insurance providers in the United States, offering a range of services including commercial auto insurance. Both companies have established themselves as reputable choices for businesses looking to protect their vehicles and assets.

Key Features

- Geico Commercial Auto Insurance:

- Competitive rates and discounts

- 24/7 customer service

- Customizable coverage options

- State Farm:

- Premium customer service reputation

- Personalized agent support

- Diverse range of insurance products

Market Presence and Reputation

Geico, known for its humorous advertising campaigns, has a strong national presence and is recognized for its affordable rates. State Farm, on the other hand, has built a reputation for exceptional customer service and a vast network of local agents.

Both companies have a solid standing in the insurance industry, with State Farm having a longer history and Geico gaining popularity in recent years.

Coverage Options

When it comes to commercial auto insurance, having the right coverage options is crucial to protect your business assets and vehicles. Let's explore the different coverage options offered by Geico Commercial Auto Insurance and State Farm.

Geico Commercial Auto Insurance

- Liability Coverage: This provides coverage for bodily injury and property damage that you are legally responsible for.

- Collision Coverage: Helps pay for repairs to your vehicle if it's damaged in a collision with another vehicle or object.

- Comprehensive Coverage: Covers damage to your vehicle from incidents other than collisions, such as theft, vandalism, or natural disasters.

- Medical Payments Coverage: Helps pay for medical expenses for you and your passengers after an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if you're involved in an accident with a driver who has little or no insurance.

State Farm

- Liability Coverage: Covers bodily injury and property damage for which you are responsible.

- Collision Coverage: Pays for damage to your vehicle if you collide with another vehicle or object.

- Comprehensive Coverage: Protects your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Medical Payments Coverage: Helps with medical expenses for you and your passengers after an accident.

- Uninsured/Underinsured Motorist Coverage: Provides coverage if you're hit by a driver with insufficient insurance.

Both Geico Commercial Auto Insurance and State Farm offer similar coverage options for commercial auto insurance. It's important to compare the extent of coverage provided by each provider, as well as any additional options or discounts that may be available to tailor the policy to your specific business needs.

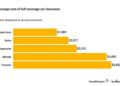

Pricing and Discounts

When it comes to commercial auto insurance, pricing and discounts play a crucial role in determining the overall cost of coverage. Let's take a look at how Geico Commercial Auto Insurance and State Farm approach pricing for their policies and the discounts they offer to help businesses save money.

Pricing Structure

Both Geico Commercial Auto Insurance and State Farm consider various factors when determining the pricing of their commercial auto insurance policies. These factors may include the type of vehicles being insured, the driving records of the drivers, the nature of the business, and the coverage limits selected.

Additionally, each provider may have its own unique algorithms and underwriting criteria that impact pricing.

Discounts Offered

Geico Commercial Auto Insurance

Geico offers a range of discounts for commercial auto insurance, such as multi-policy discounts for businesses that also have other insurance products with Geico, safety feature discounts for vehicles equipped with certain safety features, and loyalty discounts for long-term customers.

State Farm

State Farm also provides discounts for commercial auto insurance, including discounts for businesses with multiple vehicles insured, good driving discounts for businesses with a clean claims history, and discounts for completing safe driver training courses.

Potential Savings

Comparing the pricing structures of Geico Commercial Auto Insurance and State Farm can help businesses determine where they can potentially save money on their commercial auto insurance. By obtaining quotes from both providers and exploring the discounts offered, businesses can see which option provides the best value for their specific needs and budget.

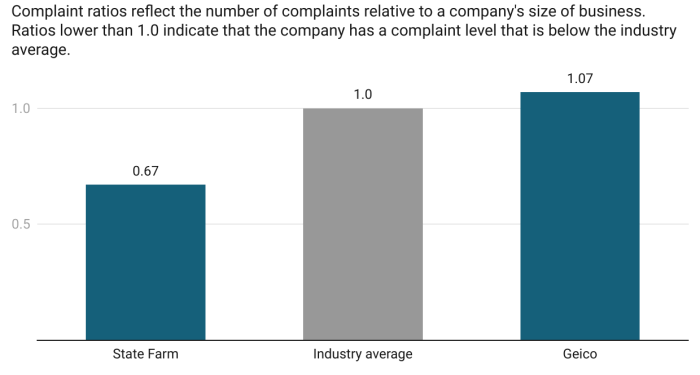

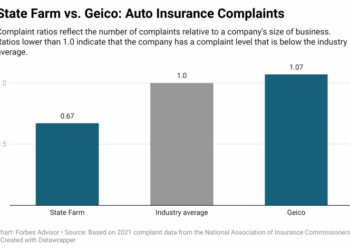

Customer Service and Claims Process

When it comes to commercial auto insurance, customer service and claims processing are crucial aspects to consider. Let's take a look at the customer service experience and claims process with Geico Commercial Auto Insurance and State Farm.

Geico Commercial Auto Insurance

- Geico is known for its user-friendly customer service, offering multiple channels for clients to reach out for assistance.

- The claims process with Geico is streamlined and efficient, with online tools available for reporting and tracking claims.

- Geico typically receives positive feedback for its prompt response times and clear communication throughout the claims process.

State Farm

- State Farm has a strong reputation for its personalized customer service, with agents readily available to address client inquiries.

- When it comes to claims, State Farm offers a straightforward process, guiding policyholders through each step with personalized support.

- State Farm is known for its commitment to customer satisfaction, often receiving high ratings for their claims handling and support.

Additional Benefits and Features

When it comes to additional benefits and features, both Geico Commercial Auto Insurance and State Farm offer a range of services to enhance the policyholder experience.

Roadside Assistance

- Geico Commercial Auto Insurance provides 24/7 roadside assistance for policyholders who may encounter issues such as flat tires, dead batteries, or lockouts.

- State Farm also offers roadside assistance as an optional add-on, providing similar services to Geico.

- Both providers aim to ensure that drivers can get help quickly and efficiently in case of emergencies on the road.

Rental Car Coverage

- Geico Commercial Auto Insurance includes rental car coverage as part of its policies, allowing policyholders to have a temporary vehicle while their car is being repaired after an accident.

- State Farm also offers rental car coverage, giving policyholders the option to add this feature to their policy for an additional cost.

- Having rental car coverage can help policyholders continue with their daily activities even when their primary vehicle is out of commission.

Supplementary Services

- Geico Commercial Auto Insurance provides additional services such as mobile app access for easy policy management, online claims filing, and personalized customer support.

- State Farm offers supplementary services like accident forgiveness, where policyholders' rates may not increase after their first at-fault accident, and the Drive Safe & Save program to save on premiums based on safe driving habits.

- Both providers focus on offering value-added services to cater to the diverse needs of their policyholders and enhance their overall insurance experience.

Closing Summary

In conclusion, Geico and State Farm both have their strengths and weaknesses when it comes to commercial auto insurance. By considering factors such as coverage options, pricing, customer service, and additional benefits, you can determine which provider aligns best with your business requirements.

Make sure to weigh the pros and cons carefully before making your final decision.

FAQ Resource

How do Geico and State Farm determine pricing for their commercial auto insurance policies?

Geico and State Farm use various factors such as driving history, type of vehicle, and coverage limits to determine pricing for commercial auto insurance policies. However, their specific algorithms and criteria may differ.

Do Geico and State Farm offer roadside assistance as part of their commercial auto insurance coverage?

Both Geico and State Farm offer roadside assistance as an additional benefit for their commercial auto insurance policies. This service can be invaluable in case of emergencies while on the road.