As Shop Car Insurance Quotes Safely on Trusted Platforms takes center stage, this guide beckons readers into a world of secure online insurance shopping. With a focus on safety and reliability, this overview ensures a thorough understanding of navigating the complex realm of car insurance quotes online.

Exploring the risks, benefits, and practical steps involved, this guide equips readers with essential knowledge for making informed decisions when comparing car insurance quotes on trusted platforms.

Importance of Shopping Car Insurance Quotes Safely

When it comes to shopping for car insurance quotes online, ensuring the safety of your personal information is paramount. Here are some reasons why it's crucial to shop for car insurance quotes safely:

Risks of Sharing Personal Information on Untrusted Platforms

Sharing personal information on untrusted platforms can lead to identity theft, fraud, and other cybercrimes. Scammers may misuse your data for malicious purposes, putting your financial security at risk.

Benefits of Using Secure Websites for Comparing Insurance Quotes

- Secure websites encrypt your data, protecting it from unauthorized access.

- Trusted platforms ensure that your information is handled securely and confidentially.

- You can compare insurance quotes from reputable providers, ensuring you get accurate and reliable information.

Tips on How to Identify Trusted Platforms for Shopping Car Insurance Quotes Safely

- Look for secure websites with "https" in the URL and a padlock symbol in the address bar.

- Check for reviews and ratings of the platform from other users to gauge its credibility.

- Avoid providing sensitive information unless you are certain of the platform's legitimacy.

Examples of Potential Scams to Watch Out for When Shopping for Car Insurance Online

- Phishing scams where fake websites mimic legitimate insurance providers to steal your information.

- Bait-and-switch tactics where scammers offer unrealistically low quotes to lure you in, only to change the terms later.

- Identity theft schemes where fraudsters use your personal information to open accounts or make purchases without your consent.

Features of Trusted Platforms for Shopping Car Insurance

When it comes to shopping for car insurance, using trusted platforms is crucial to ensure the security and protection of your personal information. These platforms offer a range of features and security measures to make the process safe and reliable.

Comparison of Trusted Platforms

- Platforms like Insurance.com, NerdWallet, and Compare.com are known for their reliable and accurate car insurance quote comparisons.

- Each platform has its unique features, such as user-friendly interfaces, detailed policy information, and customer reviews.

Security Measures Implemented

- Reputable insurance comparison websites use encryption technology to protect users' data during the quote comparison process.

- They have strict privacy policies in place to ensure that personal information is not shared with third parties without consent.

Privacy and Data Protection

- Trusted platforms have robust security protocols to safeguard users' sensitive information, such as driver's license numbers and vehicle details.

- They comply with data protection regulations to ensure that user data is handled securely and responsibly.

Verifying Legitimacy of Platforms

- Before using a platform to shop for car insurance, verify its legitimacy by checking for SSL encryption, privacy policies, and customer reviews.

- Look for accreditation from reputable organizations in the insurance industry to ensure the platform is trustworthy.

Steps to Safely Shop for Car Insurance Quotes Online

When shopping for car insurance quotes online, it's essential to take certain steps to ensure your personal information remains secure. Follow this step-by-step guide to safely compare insurance quotes and protect your data.

Create a Secure Online Profile

- When creating an online profile on insurance platforms, use a strong and unique password that includes a mix of letters, numbers, and special characters.

- Enable two-factor authentication whenever possible to add an extra layer of security to your account.

- Avoid using public Wi-Fi networks when accessing insurance platforms to prevent potential security breaches.

Review and Compare Quotes Effectively

- Provide accurate information about your vehicle, driving history, and coverage needs to receive the most accurate quotes.

- Compare quotes from multiple insurance providers to ensure you're getting the best coverage at a competitive price.

- Look for discounts or special offers that may apply to your situation to potentially lower your insurance premiums.

- Read the policy details carefully, including coverage limits, deductibles, and exclusions, to understand what you're getting with each quote.

Considerations When Comparing Car Insurance Quotes

When comparing car insurance quotes online, there are several key factors to consider to ensure you make an informed decision that meets your needs and budget. It is essential to carefully review and understand the policy details before selecting a car insurance policy.

Understanding Policy Details

- Read the fine print: It is crucial to carefully read through the policy details, including coverage limits, exclusions, deductibles, and any additional fees or charges.

- Understand the terms: Make sure you understand the terms used in the policy, such as comprehensive coverage, liability limits, uninsured motorist coverage, and more.

- Compare coverage options: Evaluate the coverage options offered by different insurance companies to determine which policy best suits your needs.

Evaluating Coverage Options and Pricing

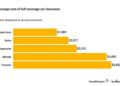

- Compare coverage levels: Consider the level of coverage offered by each insurance policy to ensure it meets your requirements, whether it's basic liability or comprehensive coverage.

- Consider pricing: While price is important, it should not be the only factor in your decision. Compare the cost of premiums with the coverage and benefits provided.

- Check for discounts: Look for any available discounts, such as safe driver discounts, multi-policy discounts, or discounts for safety features in your vehicle.

Choosing the Right Car Insurance Policy

- Assess your needs: Consider your driving habits, the value of your vehicle, and your budget when choosing a car insurance policy.

- Seek customization: Look for insurance companies that offer customizable policies to tailor coverage to your specific needs.

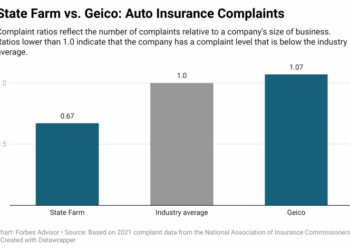

- Research the insurer: Before making a decision, research the insurance company's reputation, customer service reviews, and financial stability.

Last Recap

In conclusion, shopping for car insurance quotes safely on trusted platforms is not just about finding the best deal, but also safeguarding your personal information and financial security. By following the tips and guidelines Artikeld in this guide, you can navigate the online insurance marketplace with confidence and peace of mind.

Question & Answer Hub

What are the risks of sharing personal information on untrusted platforms?

Sharing personal information on untrusted platforms can lead to identity theft, financial fraud, and privacy breaches.

How can I identify trusted platforms for shopping car insurance quotes safely?

Look for secure websites with HTTPS encryption, check for customer reviews and ratings, and verify the legitimacy of the platform before sharing any information.

Why is it important to use strong passwords and two-factor authentication on insurance platforms?

Strong passwords and two-factor authentication add an extra layer of security to protect your account and personal information from unauthorized access.

What key factors should I consider when comparing car insurance quotes online?

Key factors to consider include coverage options, pricing, deductibles, discounts, and customer service reputation of the insurance provider.