Embark on a journey to unravel the intricacies of comparing life insurance quotes and maximizing your savings. Delve into a world where financial planning meets practical decision-making, guiding you towards securing the best coverage for your needs.

Understanding Life Insurance Quotes

When comparing life insurance quotes, it is essential to understand the components that make up the quote, the factors that influence the cost, and the types of policies available for comparison.

Components of a Life Insurance Quote

- The premium: This is the amount you pay to the insurance company in exchange for coverage.

- The coverage amount: This is the sum of money that will be paid out to your beneficiaries upon your death.

- The policy term: This is the length of time the policy will be in effect.

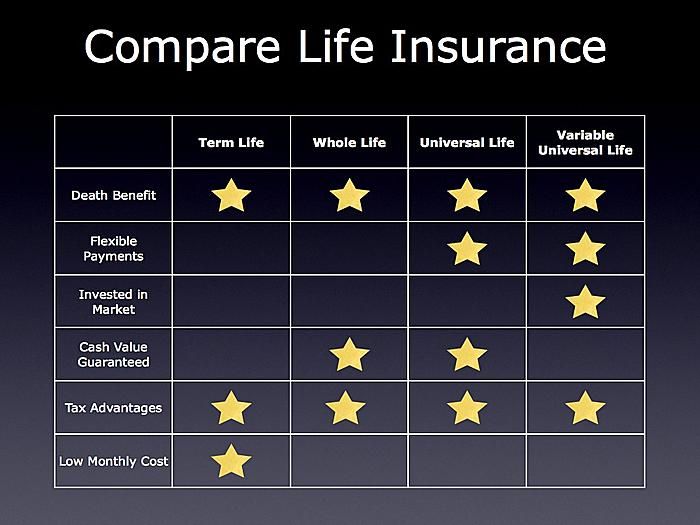

- The type of policy: There are various types of life insurance policies, such as term life, whole life, and universal life.

Factors Influencing the Cost of Life Insurance

- Age: Younger individuals typically pay lower premiums compared to older individuals.

- Health: Your health condition can significantly impact the cost of life insurance.

- Lifestyle habits: Factors like smoking, alcohol consumption, and risky activities can affect the cost.

- Coverage amount: The higher the coverage amount, the higher the premium.

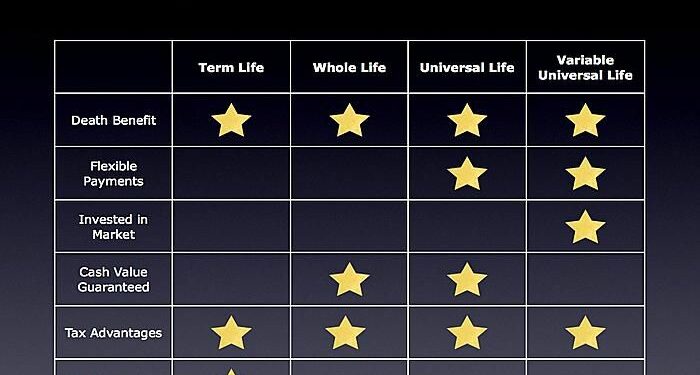

Types of Life Insurance Policies Available for Comparison

- Term life insurance: Provides coverage for a specific period, usually 10, 20, or 30 years.

- Whole life insurance: Offers coverage for your entire life and includes a cash value component.

- Universal life insurance: Combines a death benefit with a savings element that earns interest.

Gathering and Comparing Quotes

When it comes to life insurance, gathering and comparing quotes is crucial to finding the best coverage at the most affordable rates. Here is a step-by-step guide on how to request life insurance quotes and compare them effectively.

Requesting Life Insurance Quotes

- Research Insurance Providers: Start by researching reputable insurance companies that offer life insurance policies.

- Visit Insurance Websites: Visit the websites of these insurance providers and look for their life insurance quote request forms.

- Fill out Quote Forms: Fill out the necessary information on the quote request forms, including details about your age, health, and coverage needs.

- Submit Requests: Submit your quote requests to multiple insurance providers to receive a variety of quotes to compare.

Comparing Quotes

- Review Coverage Limits: Pay close attention to the coverage limits offered by each insurance provider to ensure they meet your financial needs.

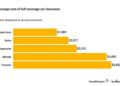

- Compare Premiums: Compare the premiums quoted by different insurance companies to find the most affordable option that fits your budget.

- Examine Benefits: Look at the benefits offered by each policy, such as riders, cash value accumulation, and policy flexibility.

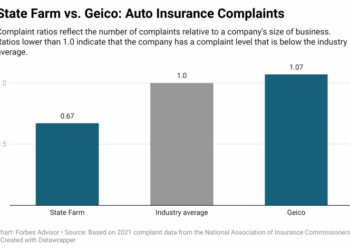

- Consider Customer Reviews: Take into account customer reviews and satisfaction ratings to gauge the quality of service provided by each insurance company.

Saving Money on Life Insurance

When it comes to saving money on life insurance, there are several strategies you can use to lower your premiums without sacrificing coverage

Discounts and Incentives

- Insurance companies may offer discounts for non-smokers, healthy individuals, or those who maintain a certain body mass index.

- Some insurers provide incentives for bundling policies, such as combining life insurance with auto or home insurance.

- Discounts may also be available for purchasing a policy at a younger age or for paying premiums annually instead of monthly.

Adjusting Coverage Amounts

- Increasing your deductible can lower your premiums, but be sure you can afford the out-of-pocket costs in the event of a claim.

- Consider only purchasing the coverage you need, as additional riders or features can increase the cost of your policy.

- Review your coverage periodically to ensure you are not overinsured, as reducing unnecessary coverage can lead to savings.

Utilizing Online Tools and Resources

When comparing life insurance quotes, utilizing online tools and resources can greatly simplify the process and help you find the best coverage at the most affordable rates.

Online Tools for Comparing Life Insurance Quotes

- Insurance Comparison Websites: Websites like Policygenius, NerdWallet, and Insure.com allow you to compare quotes from multiple insurance companies in one place.

- Insurance Company Websites: Many insurance companies have online quote tools on their websites that enable you to get instant quotes based on your information.

- Independent Agent Websites: Independent agents often have online tools that can provide quotes from various insurance carriers, giving you more options to choose from.

Benefits of Using Online Resources

- Convenience: Online tools allow you to compare quotes from the comfort of your home at any time that suits you.

- Time-Saving: Instead of contacting multiple insurance companies individually, online tools streamline the process and provide instant quotes.

- Transparency: Online resources provide transparent information on policy details, coverage options, and premium costs, helping you make an informed decision.

Using Calculators to Estimate Insurance Needs and Premiums

Insurance calculators are valuable tools that can help you estimate your insurance needs and premiums based on your financial situation and personal circumstances.

By inputting information such as your age, income, debts, and desired coverage amount, insurance calculators can generate an estimate of how much coverage you may need and the corresponding premium costs.

These calculators take into account factors like inflation, interest rates, and life expectancy to provide a comprehensive assessment of your insurance requirements.

Wrap-Up

As we conclude our exploration of comparing life insurance quotes, remember that knowledge is power when it comes to making informed choices. Take charge of your financial future by implementing the insights gained from this discussion.

Question Bank

How can I adjust coverage amounts to impact the cost of life insurance?

By increasing your deductible or reducing your coverage limits, you can lower your premiums. However, ensure that you maintain adequate coverage for your needs.

What are some discounts or incentives that insurance companies may offer?

Insurance companies often provide discounts for non-smokers, individuals with a healthy lifestyle, or those who purchase multiple policies from the same provider.

Why is it important to compare coverage limits and benefits offered?

Comparing coverage limits and benefits ensures that you choose a policy that not only fits your budget but also provides adequate protection for your loved ones.