Exploring the correlation between your credit score and auto insurance quotes, this article delves into the significance of maintaining a good credit score for lower insurance costs.

Delving further into the factors beyond credit score that influence insurance quotes, as well as the legal regulations surrounding credit-based insurance scoring.

How Credit Score Affects Your Auto Insurance Quote

Having a good credit score can significantly impact the cost of your auto insurance premiums. Insurers often use credit scores as a factor in determining the risk associated with a policyholder, affecting the overall price of the insurance quote.

Examples of Impact on Insurance Rates

- Individuals with lower credit scores are often considered higher risk by insurance companies, leading to higher premiums.

- A study by the Federal Trade Commission found that those with poor credit scores tend to file more insurance claims, resulting in increased costs for insurers.

- Drivers with bad credit scores may end up paying up to double the amount for auto insurance compared to those with excellent credit scores.

Importance of Maintaining a Good Credit Score

By maintaining a good credit score, you can potentially save hundreds or even thousands of dollars on your auto insurance premiums. Insurers view individuals with good credit as more responsible and less likely to file claims, leading to lower insurance costs.

Factors Considered by Insurance Companies

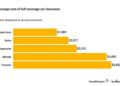

When determining auto insurance quotes, insurance companies take into account various factors beyond just credit score and driving record. These factors help insurers assess the risk associated with insuring an individual and ultimately determine the premium they will charge.

Other Factors Influencing Auto Insurance Quotes

- Age: Younger drivers typically pay higher premiums due to their lack of driving experience.

- Location: Where you live can impact your insurance rates, with urban areas often having higher rates due to increased traffic and crime rates.

- Type of Vehicle: The make and model of your car, as well as its safety features, can affect your insurance costs.

- Mileage: The number of miles you drive annually can also impact your premium, with higher mileage usually leading to higher rates.

Credit Score vs. Driving Record Impact on Insurance Premiums

- Credit Score: While credit score is an important factor, it tends to have a significant impact on insurance premiums. A lower credit score can result in higher rates, as it is often correlated with a higher likelihood of filing insurance claims.

- Driving Record: A clean driving record with no accidents or traffic violations can lead to lower insurance premiums, as it demonstrates responsible driving behavior and lower risk of accidents.

Use of Credit Information to Assess Risk

Insurance companies use credit information in conjunction with other factors to assess the risk profile of an individual. By analyzing credit history, insurers can predict the likelihood of a policyholder filing claims in the future. Those with poor credit may be perceived as higher risk and charged higher premiums to offset potential claim costs.

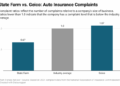

Legal Aspects and Regulations

When it comes to credit-based insurance scoring, there are regulations in place to govern its use in different states. These regulations aim to ensure fair practices and protect consumers from potential discrimination based on their credit history.

Credit-Based Insurance Scoring Regulation

In the United States, the use of credit scores in determining insurance rates is regulated at the state level

- California: California law prohibits insurance companies from using credit scores to determine auto insurance rates.

- Massachusetts: Massachusetts also restricts the use of credit scores in insurance pricing.

- Hawaii: Insurance companies in Hawaii are not allowed to use credit scores as a factor in setting insurance rates.

It's important for consumers to be aware of the regulations in their state regarding the use of credit scores in insurance pricing to understand how their credit history may impact their auto insurance premiums.

Ways to Improve Your Credit Score for Lower Premiums

Improving your credit score can lead to lower auto insurance premiums. Insurance companies often use credit scores as a factor to determine rates, so boosting your score can save you money in the long run.

1. Pay Your Bills on Time

Making timely payments on all your bills, including credit cards, loans, and utilities, can show responsible financial behavior and improve your credit score.

2. Reduce Credit Card Balances

Lowering your credit card balances can help improve your credit utilization ratio, which is the amount of credit you are using compared to your total credit limit.

3. Check Your Credit Report Regularly

Reviewing your credit report for errors and inaccuracies can help you identify any issues that may be negatively impacting your score. Disputing and correcting these errors can boost your credit score.

4. Avoid Opening Too Many New Accounts

Opening multiple new credit accounts in a short period of time can lower your average account age and negatively impact your credit score. Limit new credit applications to avoid potential score decreases.

Conclusive Thoughts

In conclusion, understanding how your credit score affects your auto insurance quote is crucial in making informed decisions to potentially lower your premiums.

Popular Questions

How does my credit score affect my auto insurance premium?

Your credit score can impact your auto insurance premium as insurance companies often use it to assess the level of risk you pose as a policyholder.

What are some strategies to improve my credit score for lower insurance premiums?

To improve your credit score, you can start by paying bills on time, reducing debt, and monitoring your credit report regularly.

Are there states where credit scores cannot be used to determine insurance rates?

Yes, some states have regulations that restrict the use of credit scores in determining insurance rates to protect consumers.